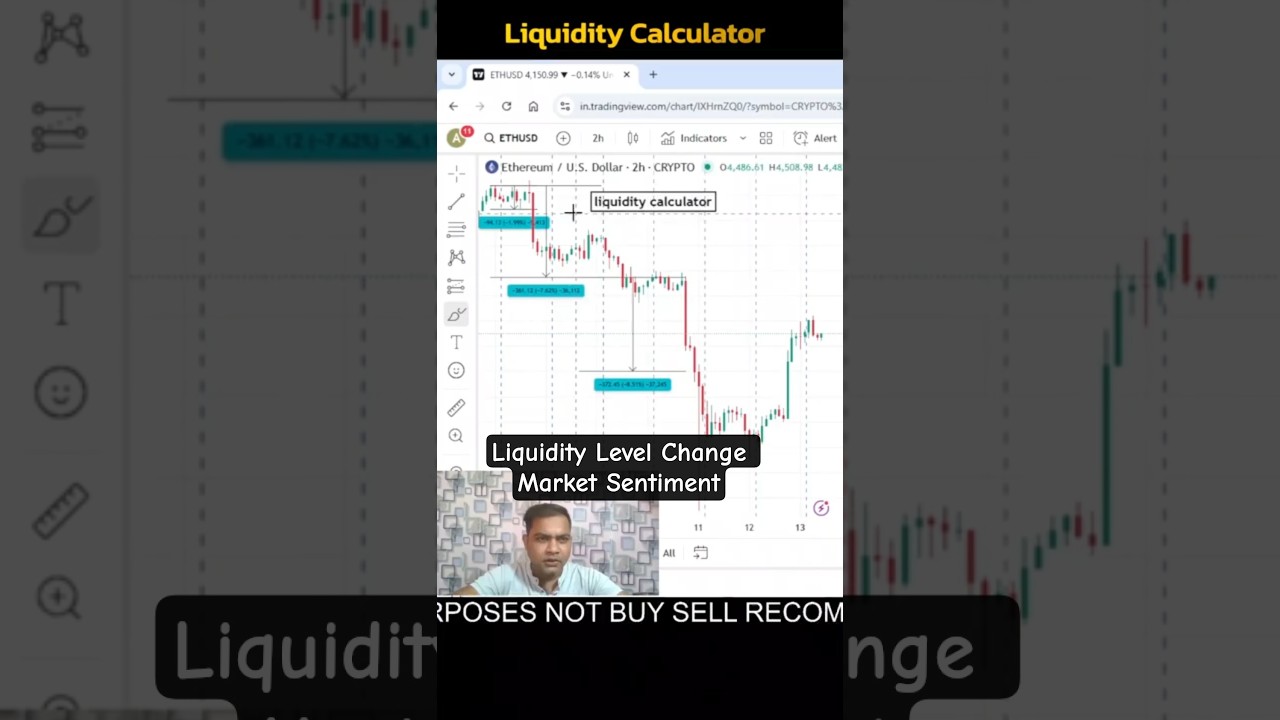

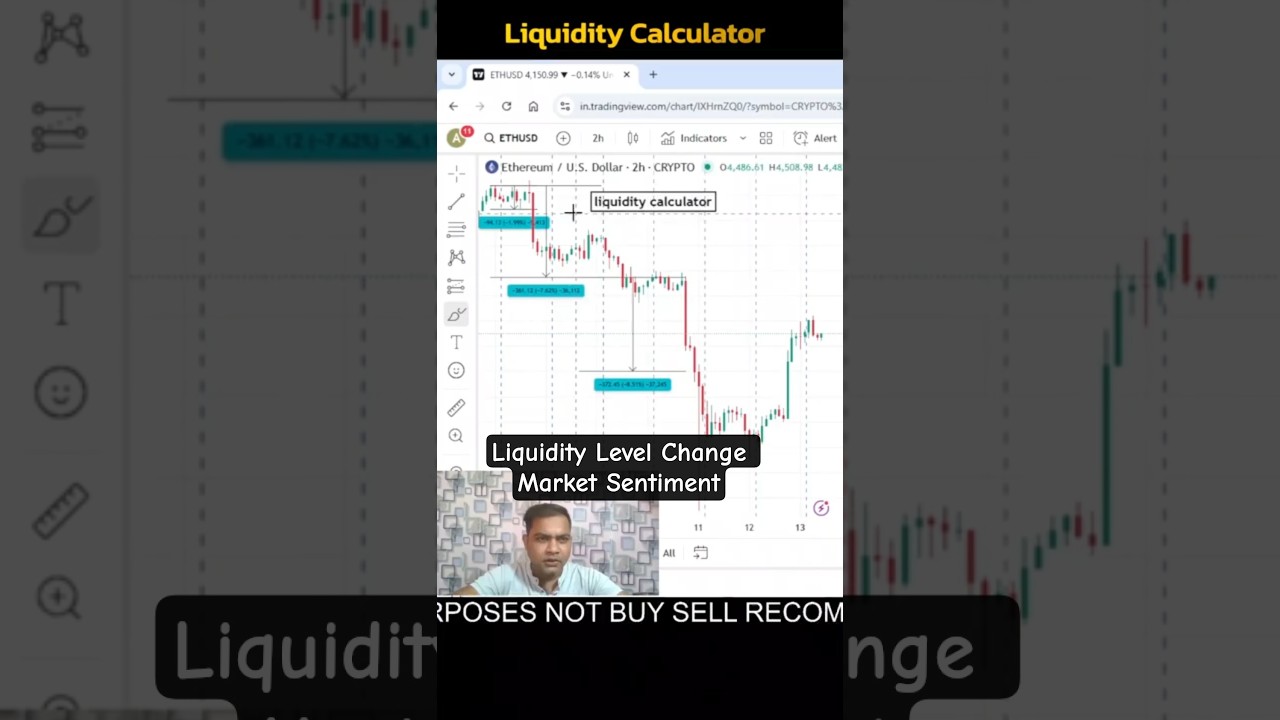

One Liquidity Level Can Change Entire Market Sentiment – In trading, everything starts and ends with liquidity. A single liquidity level can decide whether the market will continue its trend or reverse completely. Every big move, breakout, or crash starts when smart money targets liquidity pools and manipulates market sentiment. This video explains how identifying one powerful liquidity zone using the Liquidity Calculator can help you understand institutional movements in crypto trading, forex trading, and stock indices before they happen.

Most traders look at indicators, RSI, or MACD — but institutional traders only look at liquidity levels and order flow. When price reaches a liquidity zone, it reacts with strong momentum shifts that can completely change the market direction. Understanding these key levels can help you avoid false breakouts, liquidity traps, and manipulation spikes.

📘 In This Video You’ll Learn:

How one liquidity zone can shift market sentiment instantly

Identify institutional liquidity pools where smart money enters or exits

Understand order flow, market structure, and imbalance before reversals

Learn how to use the Liquidity Calculator to detect high-probability zones

Decode how market makers trap retail traders during high volatility

🔥 Why Liquidity Controls Market Sentiment:

Every candle you see on the chart reflects liquidity collection and distribution. Institutions don’t trade against you — they trade to fill large orders where liquidity is available. When retail traders enter late or chase price, they get caught in liquidity sweeps that change trend bias and market psychology. Liquidity zones are the true “heartbeat” of the market, controlling price reactions on BTC/USD, EUR/USD, NASDAQ, Gold, and major forex pairs.

When price hits a strong liquidity level, it can cause a trend reversal, continuation, or major breakout. That’s why professional traders track liquidity as the foundation of smart money concepts (SMC), price action trading, and institutional analysis.

💡 Core Trading Keywords in This Video:

Liquidity zones, market sentiment, order flow trading, smart money concepts, institutional liquidity, imbalance trading, fair value gaps, market manipulation, order blocks, price action strategy, trend reversal, swing trading, forex liquidity, crypto market analysis, stop hunts, liquidity sweeps, market structure, trading psychology, supply-demand imbalance, and precision trading zones.

📊 Benefits of Using Liquidity Calculator:

Detect market reversal zones before they form

Avoid fake breakouts and liquidity traps

Identify smart money footprints in every market

Spot momentum shifts using liquidity imbalance

Predict trend changes with high accuracy

Works in Crypto, Forex, Stocks, and Indices

💥 Why Traders Lose Without Liquidity Knowledge:

Most traders lose money because they ignore where liquidity resides. Indicators lag, but liquidity levels reveal where the next move begins. The Liquidity Calculator helps traders pinpoint potential breakout zones, stop hunt regions, and order flow shifts. Once you understand this logic, you’ll never see charts the same way again.

This tool is designed for both beginners and professional traders who want to understand the real mechanism behind market structure and sentiment shifts. Whether you scalp or swing trade, this approach will strengthen your entry confirmation and exit planning.

📈 How Market Sentiment Changes with Liquidity:

When institutions push price into a liquidity pool, it triggers stop-loss orders and activates pending orders. This massive influx of buy/sell pressure alters sentiment instantly — turning bullish markets bearish or vice versa. That’s why tracking liquidity distribution and imbalance helps traders forecast reversals, retracements, and fakeouts with precision.

Using the Liquidity Calculator, you can identify:

Liquidity sweeps before reversals

Imbalance corrections before momentum shifts

Order block zones before breakout confirmations

Fair value gaps signaling institutional interest

🚀 Key Topics Covered:

Liquidity-driven market reversals

Institutional sentiment analysis

Order block and smart money footprints

Market manipulation detection

Price action and liquidity correlation

Liquidity imbalance strategy

Volatility control using liquidity zones

Market trap and sentiment shift recognition

👉 Like, Share, and Subscribe for more insights on Liquidity-Based Trading!

📞 For Access to Liquidity Calculator: +91 6296835756

---

Disclaimer:

This Liquidity Calculator Only Calculates Points. Does Not Constitute Financial Advice or Recommendations. Does Not Provide Buy/Sell Recommendations. We are not responsible for any losses incurred based on the information provided. Please Consult Your Financial Advisor Before Taking Any Trade or Investment. If You Do Not Agree To These Terms and Conditions, Please Do Not Use the Calculator. Calculator May Change, Modify, or Update at Any Time Without Notice.

Информация по комментариям в разработке