Rob Roy provides comprehensive Elliott Wave analysis for stock, crypto and option traders, covering the current state of interest rates, focusing on the TNX and its implications for the broader economy. Rob also covers the performance of bonds. He also examines the U.S. dollar's stability. The video includes insights on market volatility through the VIX, along with an analysis of major indices such as DIA, QQQ, and IWM. Rob also touches on the movements in cryptocurrencies like Bitcoin, and offers an in-depth review of specific stocks, including Apple (AAPL) and Under Armour (UA). The session concludes with a preview of the Jackson Hole Summit and its potential impact on the markets next week.

:: How to Subscribe to TRADEFINDER LIVE! for Free ::

------------------------------------------------------------------------------------

Become a FREE Tradefinder Member using the link below.

As a subscriber you’ll watch live as Rob finds new trading opportunities each week.

► Registration Link: https://ewotrader.com/tradefinder/

:: Subscribe to the HUBB Channel for Live Updates and Q&A ::

---------------------------------------------------------------------------------------------------

To participate in Q&A with Rob Roy, join us at the HUBB YouTube channel. Click the link below now to subscribe for free.

► Registration Link: / @hubb_financial

:: Sections in this Video ::

------------------------------------------------------------------------------------

00:00 - Introduction

00:36 - US Market News

01:16 - SPY

05:20 - TNX

06:05 - TLT

07:27 - US Dollar

08:08 - VIX

08:45 - DIA

09:17 - QQQ

10:18 - IWM

11:21 - Bitcoin

12:11 - CLSK

13:06 - GLD

14:58 - SLV

15:42 - UNG

17:06 - USO

18:15 - PLTR

19:06 - JEPI

20:26 - AAPL

21:33 - UA

23:16 - TradeFinder

:: To receive TRADE ALERTS for our strategies see links below ::

------------------------------------------------------------------------------------------------

► EWO Volatility Strategy https://ewotrader.com/the-volatility-...

► EWO Impulse Strategy https://ewotrader.com/the-impulse-str...

► EWO Time Strategy https://ewotrader.com/the-time-strategy/

:: Other Links to Follow Us::

--------------------------------------------

► Instagram: / elliottwaveoptions

► Facebook: / elliottwaveoptions

► LinkedIn: / elliott-wave-options

► Twitter: / ewotrader

► Website: http://www.ewotrader.com

Rob examines the TNX, noting that while rates have stabilized after a significant drop, they remain at lower levels. Next, Rob shifts his attention to the U.S. dollar, highlighting its recent stabilization but noting some weakness due to shifts in global currency trades, particularly the Yen carry trade. He emphasizes that while a moderately strong dollar is healthy for the market, extremes in either direction could pose risks to equities.

Rob then analyzes market volatility, using the VIX as a key indicator. He points out that after a recent spike, the VIX has returned to its usual range, suggesting that market fears have temporarily eased. However, he remains cautious about potential volatility as key events, like the Jackson Hole Summit, approach.

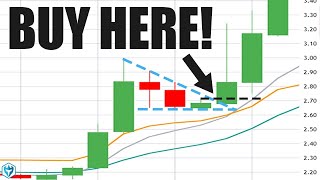

The video also covers major stock indices, including DIA, QQQ, and IWM. Rob notes a significant bounce in these indices but warns of possible resistance levels ahead. He highlights the importance of watching for potential pullbacks or consolidations, particularly in the context of the ongoing economic uncertainties.

Rob then explores the cryptocurrency market, focusing on Bitcoin, which is forming a large triangle pattern. He advises traders to wait for a breakout before committing to a direction, as these patterns can lead to significant moves in either direction. He also briefly touches on CLSK, a crypto-related stock, noting its recent movements and potential for further gains if Bitcoin remains strong.

In the commodities segment, Rob discusses gold (GLD) and silver (SLV). He notes that GLD has broken out of a triangle pattern and is showing signs of continued strength, particularly as the market anticipates further rate cuts. Silver, while not as strong as gold, is also moving higher and could play catch-up if current trends continue.

Finally, Rob reviews natural gas (UNG) and oil (USO), both of which are forming triangle patterns of their own. He highlights the potential for significant breakouts in these commodities, particularly as seasonal factors come into play.

The video concludes with a review of specific stocks like Apple (AAPL) and Under Armour (UA), where Rob analyzes recent price movements, identifies key levels of support and resistance, and offers insights into potential trading opportunities. He wraps up by previewing the Jackson Hole Summit, noting that it could be a major catalyst for market moves in the coming week.

Информация по комментариям в разработке