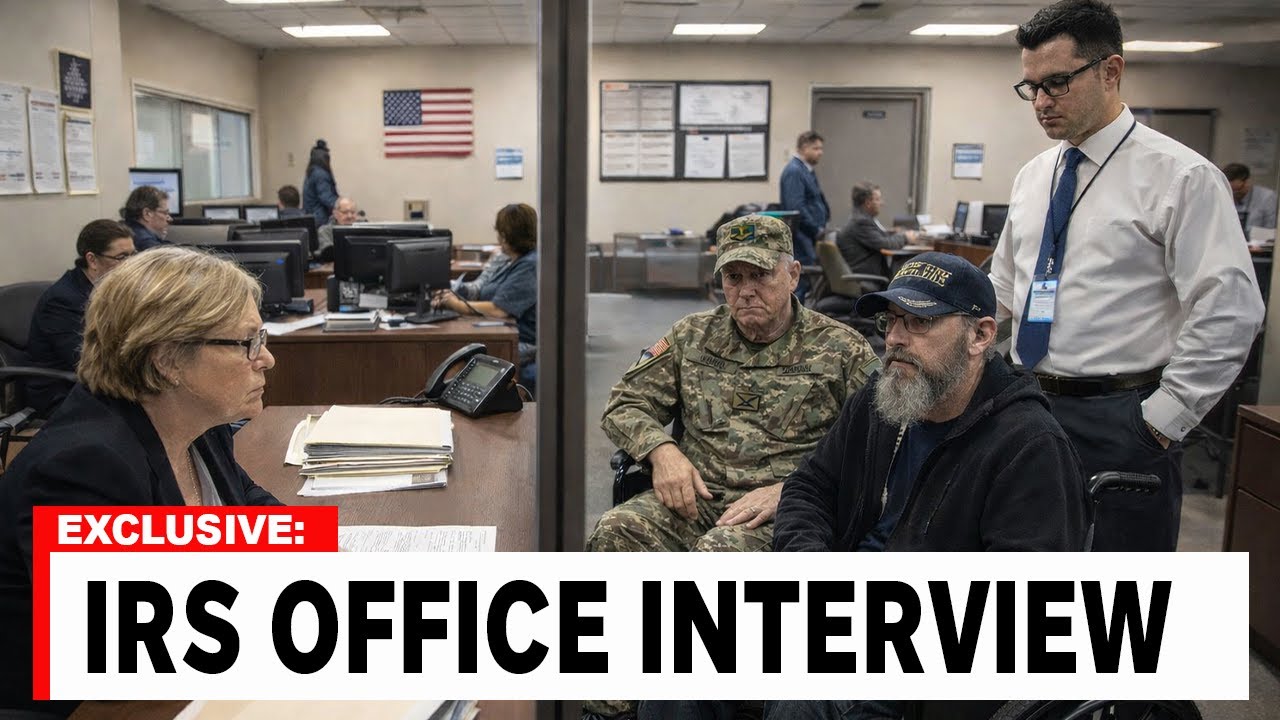

Are you a disabled veteran who thinks your benefits are completely safe from the taxman? If you’re relying on old knowledge, you could be leaving thousands of dollars on the table, or worse, setting yourself up for an unnecessary headache with the Internal Revenue Service. The relationship between the VA, military retirement pay, and the IRS has undergone a fundamental, confusing, and frankly, life-changing shift over the last few years. This isn't just about filing tax-free income; it’s about navigating complex concurrent receipt rules, leveraging new court rulings, and understanding why the IRS is suddenly paying much closer attention to how you report your income. We’re diving deep into the 7 critical shifts in how the IRS now treats disabled veterans, and one of these changes could entitle you to a massive refund you didn't even know existed.

The first critical shift, and the one that causes the most confusion, is the fundamental conflict between how the VA defines compensation and how the IRS defines income. For decades, VA disability compensation has been clearly excluded from gross income. This is a bedrock principle. But the moment a veteran receives both military retirement pay and VA disability—a situation known as concurrent receipt—the lines blur, and the IRS steps in. Military retirement pay is generally taxable, but when a disability rating offsets that retirement pay, the portion attributed to the disability becomes tax-exempt. The shift isn't in the rule itself, but in the intensity of the scrutiny. As more veterans qualify for concurrent receipt, often due to increased disability ratings later in life, the IRS is now demanding clearer documentation on the exact dollar amounts shifted from taxable retirement to non-taxable disability. This shift forces the veteran to proactively prove the exclusion, rather than the IRS simply accepting the VA’s designation. If you receive a 1099-R showing retirement pay, but a portion of that was waived for disability, the IRS needs to see the specific VA documentation proving that waiver, and they are becoming far less forgiving if the numbers don't match up precisely on your return. This is the foundational trap: assuming the two agencies communicate seamlessly when they absolutely do not.

The second major shift stems directly from recent legislative actions, particularly the expansion of presumptive conditions. When Congress passes massive acts like the PACT Act, which dramatically expands the list of conditions presumed to be service-connected, hundreds of thousands of veterans suddenly become eligible for VA disability compensation, often retroactively. This influx changes the IRS's landscape entirely. Suddenly, the IRS isn't just dealing with a steady trickle of new disability claims; they are facing a flood of veterans who are receiving massive, multi-year lump-sum payments. Because these payments are retroactive, they often correct previous years where the veteran was paying taxes on retirement pay that should have been classified as tax-free disability. The IRS's internal guidance had to rapidly evolve to handle this volume. Before these legislative pushes, retroactive corrections were handled on a case-by-case basis, often relying on complex amended returns. Now, because of the sheer scale, the IRS has had to formalize and streamline the process for correcting past tax returns, effectively creating a new, separate track for handling veteran disability back pay. This massive legislative catalyst is why the IRS is now treating veteran tax situations differently—it’s a matter of volume and necessary administrative procedure.

Информация по комментариям в разработке