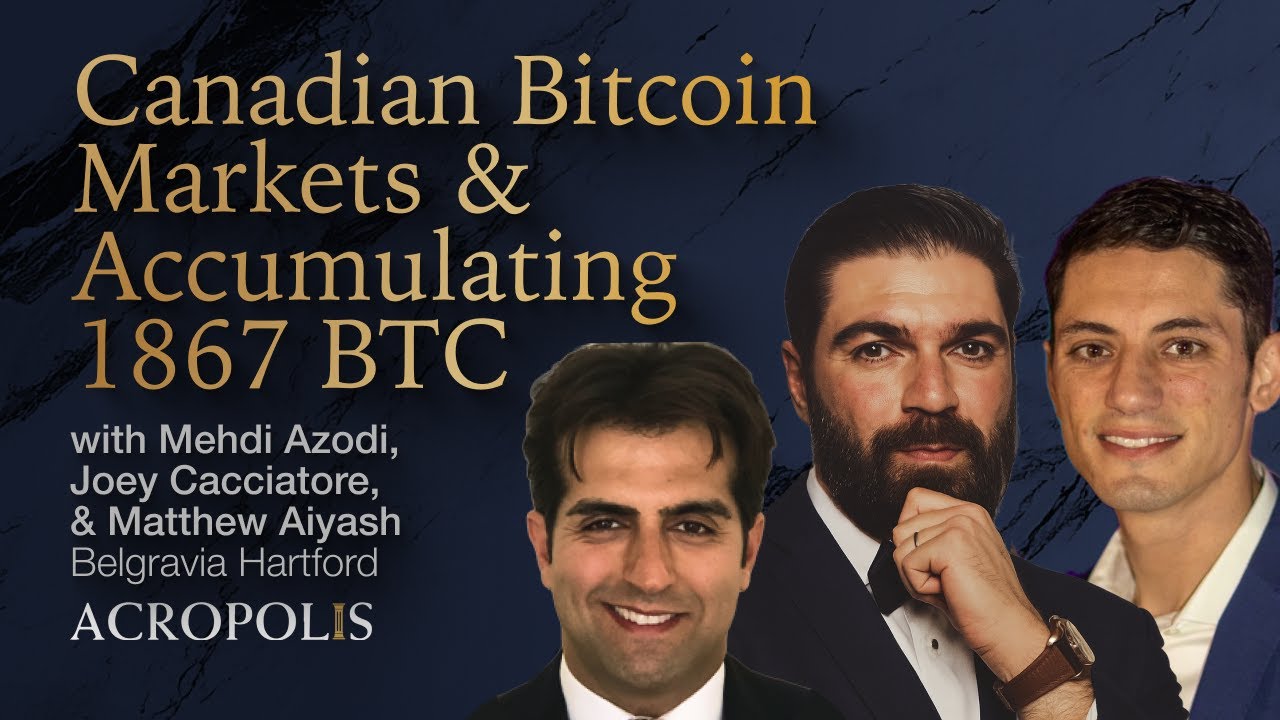

In this episode of New Foundations, we’re joined by Medi Aot, Joey Kacia, and Matt Ayash of Belgravia Hartford (BLGV) — a Canadian public company taking a bold Bitcoin-only approach to treasury strategy.

Belgravia’s goal is clear: acquire 1,867 Bitcoin (a nod to Canada’s founding year) and long term secure 1% of all supply. From Canada’s early ETF and mining leadership to the unique advantages of its public markets, the team explains why they’re positioning Belgravia as a pure-play Bitcoin treasury — no ETH, no altcoins, just BTC.

In this conversation, we cover:

Why Belgravia is 100% Bitcoin and how that differentiates them

Canada’s structural advantages for public Bitcoin treasuries

Financial engineering and why MNAV premiums exist

The role of multi-institution custody for corporate adoption

Balancing transparency, shareholder trust, and custody strategy

Belgravia’s analytics hub: BLGVBTC.com

If you want to understand how small-cap treasuries are using Canada’s public markets to aggressively accumulate Bitcoin, this episode is a front-row seat.

📌 Book a free consultation with Acropolis: https://www.acropolistreasury.com/book

00:00 – Bitcoin Only, Bitcoin Forever: Belgravia Hartford

00:36 – Canada’s Early Bitcoin Adoption Advantage

00:43 – Goal: Acquire 1,867 Bitcoin (Canada’s Founding Year)

01:28 – Welcome to New Foundations Podcast

01:44 – Guests: Medi Aot, Joey Kacia, Matt Ayash (Belgravia Hartford)

02:32 – Bitcoin as Commodity vs. Galaxy of Its Own

04:33 – Why Belgravia Is 100% Bitcoin, Not ETH or Altcoins

05:40 – Unique Advantages of Canadian Public Markets

06:51 – Canada’s Mining Strength and Loyal Shareholder Base

08:21 – Canadian Bitcoin Community and ETF Legacy

09:45 – Acropolis Treasury Advisory & Multi-Institution Custody

11:00 – Small Cap Bitcoin Treasuries and Retail Investor Multiples

12:06 – Timing Belgravia’s Entrance Into Bitcoin Strategy

13:41 – Family Legacy, Stewardship, and Bitcoin Custodianship

14:51 – Short-Term Goal: 1,867 BTC, Long-Term Goal: 1% of Supply

15:46 – Financial Engineering the World’s Best Asset

17:12 – Bitcoin Dedication as Differentiator

17:42 – Why Bitcoin Treasuries Trade at Premiums to MNAV

19:26 – Belgravia’s Bitcoin Treasury Strategy on a Scale of 1–10

20:58 – Aggressive Accumulation and Market Rewards

22:33 – Bitcoin as Digital Gold Rush of the Decade

23:11 – Long-Term Success: Top 5, Top 10, or Top 20 in Canada

24:28 – Custody Strategy: Balancing Self-Custody and Institutions

27:35 – One Asset Company: Bitcoin Only

29:25 – Building a Transparent Bitcoin Treasury Analytics Platform (BLGVBTC.com)

31:33 – Future Tools: AI, Bitcoin DEX, Mobile App

32:29 – Where to Find Medi, Joey, and Matt Online

33:21 – Outro and Disclaimer

New Foundations: a weekly podcast covering the need for businesses to embrace Bitcoin, as both a reserve asset and a disruptive settlement layer. Hosted by Mason Carter, Chase Palmieri, and rotating guests. The show is presented by Acropolis, the comprehensive treasury solution for the Bitcoin age. Acropolis believes that every business will hold Bitcoin, and it works to pull that future into the present. Visit acropolistreasury.com to learn more.

Информация по комментариям в разработке