In this video we discuss what is the difference between the nominal interest rate and the effective interest rate. We go through a couple of examples explaining how these are calculated

Transcript/notes

The nominal interest rate is the stated rate and it does not take into account different compounding periods. The effective rate of interest does take into account different compounding periods.

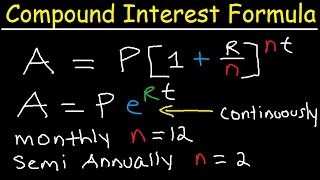

As a basic example, if you invest $100 in an account that pays an interest rate of 8% per year compounded yearly or annually. Then the rate of 8% is the stated or nominal rate. So, at the end of the year, you will receive 8% interest on your investment. To calculate this, we multiply $100 times .08, the decimal value of 8%, which equals $8. So, after 1 year, you will have $108 in the account, the $100 original investment plus the $8 of earnings.

Now, let’s change the example up a little, this time you invest $100 in an account that pays an interest rate of 8% per year compounded quarterly, so 4 times per year. Again, the stated or nominal rate is 8%, but the effective rate is actually higher than 8%. We are going to go through this in detail. Here is a timeline for 1 year, at the beginning of the year you invest $100.

The interest for this account is compounded quarterly, 4 times per year, 12 months divided by 4 equals 3. So, every 3 months interest will be compounded, or added to the account. This will be at the end of month 3, month 6, month 9 and month 12, which I have marked on the timeline.

At the end of month 3, March, is the first compound. To calculate this, we don’t use 8%, because that is a yearly rate not a quarterly rate. To get the quarterly rate we divide the yearly rate of 8% by 4, which is 2% or .02. And this is the value we will use at the end of each of the 4 compound periods to calculate the interest earned.

So, to calculate the interest earned at the end of the first quarter, we have $100 times .02, which equals $2. So, after the first quarter, the account has the $100 original investment plus the $2 of interest earned. And the total in the account is now $102.00.

Now for the end of the second quarter after month 6, at the end of June. The interest earned will now be the $102 in the account times, again, 2% or .02, which equals $2.04. So, the account now has the $100 original investment plus the $2 of interest earned at the end of the first quarter, plus the $2.04 interest earned at the end of the second quarter. And the total in the account is now $104.04.

Now for the end of the third quarter after month 9, at the end of September. The interest earned will now be the $104.04 in the account times, again, 2% or .02, which equals $2.0808, I am not going to round it off yet. So, the account now has the $100 original investment plus the $2 of interest earned at the end of the first quarter, plus the $2.04 interest earned at the end of the second quarter plus the $2.0808 interest earned at the end of the third quarter. And the total in the account is now $106.1208.

Now for the end of the fourth quarter after month 12, at the end of December, the end of the year. The interest earned will now be the $106.1208 in the account times, again, 2% or .02, which equals $2.122416. So, the account now has the $100 original investment plus the $2 of interest earned at the end of the first quarter, plus the $2.04 interest earned at the end of the second quarter plus the $2.0808 interest earned at the end of the third quarter, plus the $2.122416 interest earned at the end of the fourth quarter. And the total in the account is now $108.24 rounded off.

So, if we compare example 1 and example 2, the account that compounds more, has more money in it. Meaning, the actual rate of interest, is larger in example 2. In both examples, the stated rate or nominal rate of interest was 8%. To calculate the actual rate of interest we divide the interest earned by the original investment, for example 1 we have $8.00 divided by $100, which equals 8%.

For example 2, we have $8.24 divided by $100, which equals 8.24%. And this 8.24% is the effective rate of interest. For example 1, since there is only the 1 compounding period per year, the effective rate equals the nominal rate of 8%.

To sum things up, if interest is only compounded once per year, then the nominal rate and effective rate are the same, and if interest is compounded more than once per year, then the effective rate will be higher than the nominal rate.

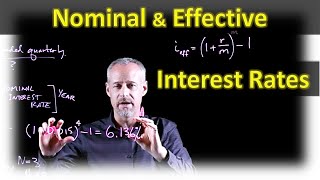

And here is the formula to calculate the effective rate with all of the variables listed, and the calculation using our numbers from example 1 and 2.

Chapters/Timestamps

0:00 Intro

0:10 Nominal rate of interest example

0:43 Effective rate of interest example

1:02 Compound interest explained

4:05 How to calculate the effective rate of interest

4:47 Formula to calculate the effective rate of interest

Информация по комментариям в разработке