In this video, we explain FIFO, LIFO, weighted average inventory cost flow methods

Start your free trial: https://farhatlectures.com/courses/fi...

FIFO, LIFO, and Weighted Average Inventory Cost Flow Methods

Introduction

Inventory cost flow methods are essential for businesses to track and value their inventory and determine the cost of goods sold (COGS). The three most commonly used methods are FIFO (First In, First Out), LIFO (Last In, First Out), and Weighted Average. Each method assigns costs to inventory and COGS differently, which can significantly impact financial statements, tax liabilities, and profitability. In this blog, we will explain how each method works and discuss their advantages and disadvantages.

1. FIFO (First In, First Out)

FIFO assumes that the oldest inventory items (those purchased first) are sold first. As a result, the costs associated with the earliest inventory purchases are assigned to COGS, while the remaining newer inventory costs are reflected in ending inventory.

Key Features:

Oldest costs are assigned to COGS.

Newest costs remain in ending inventory.

Example: A company buys 100 units at $10 per unit, then buys 100 more at $12 per unit. If it sells 150 units, the COGS would be:

COGS = (100 units * $10) + (50 units * $12) = $1,000 + $600 = $1,600

Ending inventory would be the 50 remaining units at $12, totaling $600.

Advantages:

Provides a better representation of current inventory values.

In periods of rising prices, FIFO results in lower COGS and higher net income.

Disadvantages:

Higher net income can result in higher taxes.

Ending inventory may be overstated during inflation.

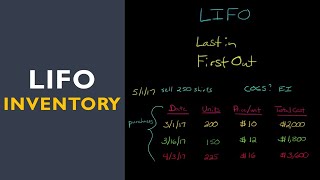

2. LIFO (Last In, First Out)

LIFO assumes the most recent inventory purchases are sold first. The costs of the most recent purchases are assigned to COGS, while the older inventory costs remain in ending inventory.

Key Features:

Newest costs are assigned to COGS.

Oldest costs remain in ending inventory.

Example: Using the same scenario as FIFO, if the company sells 150 units under LIFO:

COGS = (100 units * $12) + (50 units * $10) = $1,200 + $500 = $1,700

Ending inventory would consist of the 50 remaining units at $10, totaling $500.

Advantages:

Results in lower net income and reduced taxes during inflation.

Matches current costs with current revenues, providing a more accurate picture of profitability during inflationary periods.

Disadvantages:

Ending inventory may be undervalued.

Not allowed under IFRS, making it only usable under U.S. GAAP.

Lower net income may not appeal to investors.

3. Weighted Average

The Weighted Average method averages the cost of all available inventory to determine the COGS and ending inventory value. This method smooths out price fluctuations over time, providing a consistent and moderate impact on financial statements.

Key Features:

Averages all inventory costs for COGS and ending inventory.

Does not differentiate between the timing of purchases.

Example: If a company buys 100 units at $10 and 100 units at $12, the weighted average cost per unit would be:

Weighted Average Cost = ($10 * 100 + $12 * 100) ÷ 200 = $2,200 ÷ 200 = $11 per unit

If the company sells 150 units, the COGS would be:

COGS = 150 units * $11 = $1,650

Ending inventory would be the 50 remaining units at $11, totaling $550.

Advantages:

Simple and easy to calculate.

Smooths out cost fluctuations over time.

Suitable for businesses with homogenous inventory items.

Disadvantages:

May not accurately reflect the impact of inflation or deflation.

Can distort actual costs if there are large price changes.

Business Size and Structure:

Small businesses or companies with stable prices may benefit from FIFO.

Companies experiencing inflation may prefer LIFO to reduce taxable income.

Businesses with homogenous products may use the Weighted Average method for simplicity.

Tax Strategy:

FIFO can result in higher tax liabilities in periods of inflation, as lower COGS increases profits.

LIFO is favorable for businesses aiming to reduce tax burdens during inflation.

Financial Reporting:

FIFO is often preferred under IFRS and provides better representation of inventory value on the balance sheet.

LIFO is restricted to U.S. GAAP and is not accepted under IFRS.

Conclusion

Understanding the differences between FIFO, LIFO, and Weighted Average is crucial for making informed decisions regarding inventory management and financial reporting. FIFO provides higher profits in inflationary periods but may increase tax liabilities. LIFO reduces tax liabilities but may understate inventory values, while Weighted Average smooths out cost fluctuations, offering a middle ground. Businesses should choose the method that aligns best with their financial strategy and inventory characteristics.

#accountingexam #accountingtutorial #accountingtutor

Информация по комментариям в разработке