At Rocky Ledge Estates, we understand the concerns surrounding the real estate investment landscape, especially when it comes to family and what happens when we die. This video is for informational purposes only.

Unique Advantages of the Legacy Anchor Partnership (LAP) Model

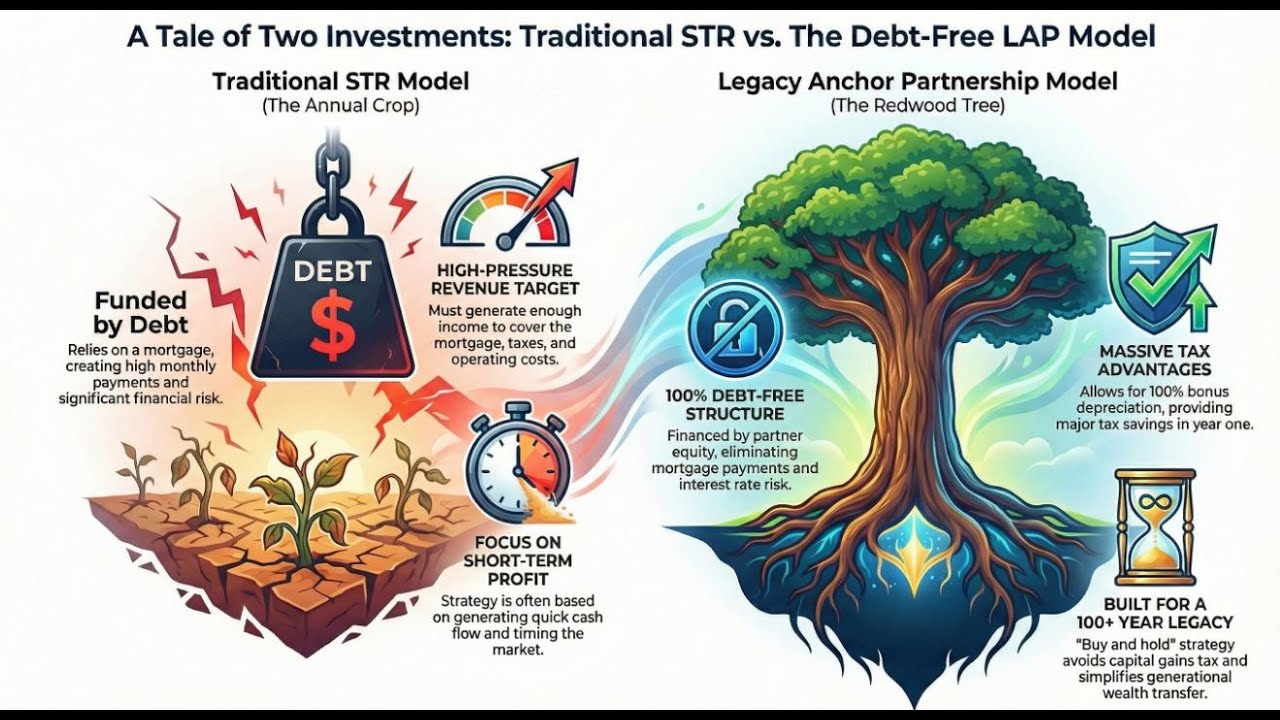

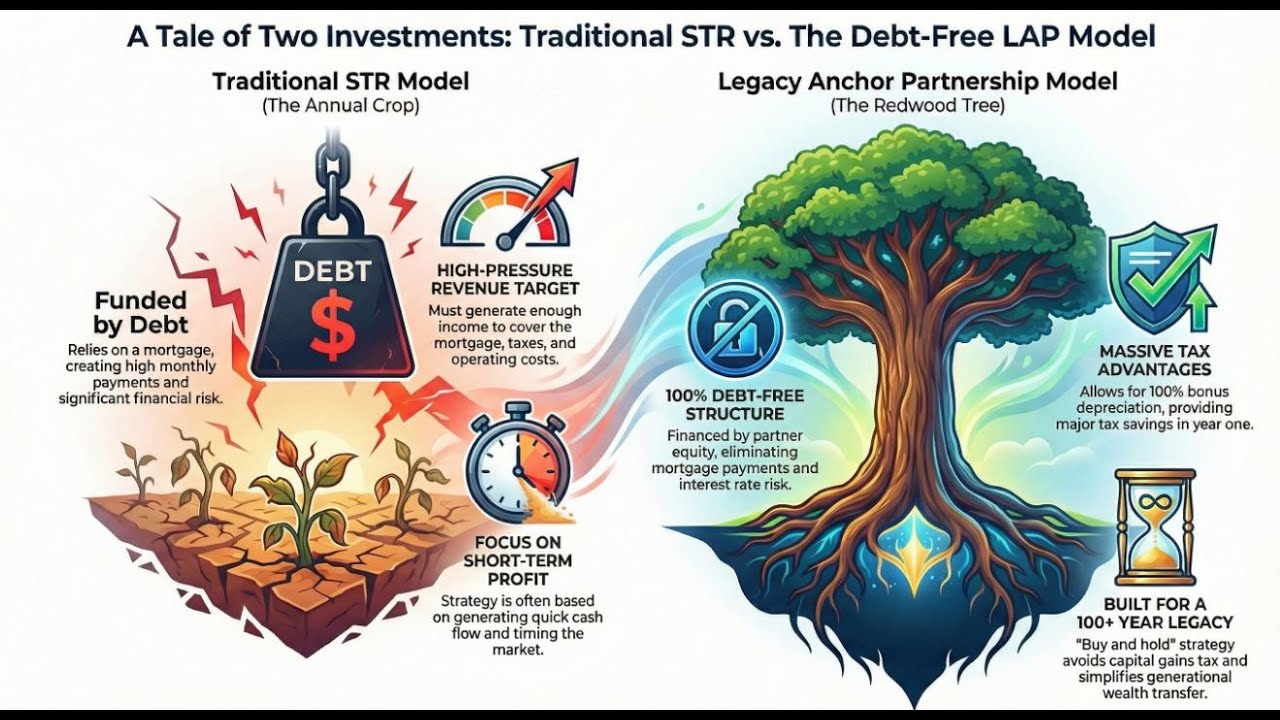

The LAP structure addresses the uncertainties inherent in running a business and aims to secure generational wealth, differentiating itself sharply from the typical STR investment:

1. Debt-Free Structure and Risk Mitigation: The LAP model operates entirely debt-free, achieved by using partner capital for construction equity,,,. This structure eliminates interest rate and refinance risk. By removing the large monthly mortgage payment (cited as $90,000 per month saved across the resort), the profits generated pass directly to the Limited Partners (LPs) via K-1 distributions. This fundamentally safeguards the inheritance, as the asset is protected from the uncertainties of running out of money due to excessive mortgage burdens,.

2. Tax Mastery: 100% Bonus Depreciation: The project leverages the ability to deduct 100% bonus depreciation on the entire investment, including the new construction assets (the $945,000 cost per STR),. This incentive allows investors to deduct the full cost of qualifying depreciable assets in the first year they are placed in service, providing immediate, significant tax savings and improving cash flow, an advantage made permanent by the "One Big Beautiful Bill Act" (OBBBA) in 2025,,.

3. Perpetual Legacy and Asset Protection: The LAP opportunity is explicitly designed as a "debt-free dynasty", intended to last for over 100 years. It utilizes a "buy and hold" strategy, meaning the assets are never sold, thus avoiding capital gains taxes,. The real estate is held within an LLC owned by the Limited Partnership (LP),, ensuring that upon the investor's death, heirs retain ownership without triggering title changes that might incur taxes, probate, or trust battles,.

4. Optimized Revenue Strategy (Three Partner Scenario and Weekly Stays): The location of Rocky Ledge Estates near Burney Falls is described as terrific for destination travel,. The business model focuses on attracting large groups and requires reservations for one week only with a minimum rate of $7,000 per week for the Private Resort Home (PRH). The PRH design accommodates up to four families (16 people) with equal luxury suites, fostering communal joy while preventing the conflict often found in traditional STRs,.

5. If only three partners invest equally in the $10 million total LP capitalization, each partner contributes approximately $3,333,333 and receives approximately a 33.33% ownership interest. This large share provides immediate and enhanced benefits, including:

◦ A greater share of the guaranteed Luxury Home Exchange barter points, used for global tax-free family travel,.

◦ A larger proportionate share of the $6.45 million in future bonus depreciation as the homes are placed into service,.

6. Property Tax Protection: The LAP asset benefits from California's Proposition 13, which protects the property tax rate, ensuring that it can only increase by a maximum of 2% per year,. This long-term advantage locks in low ownership costs, protecting profitability as rental fees increase,.

In essence, the traditional data-driven STR analysis focuses primarily on short-term cash flow viability under a debt-leveraged model,. In contrast, the LAP model uses its debt-free structure to redefine the metrics, minimizing risk, maximizing tax efficiency (via 100% bonus depreciation), and emphasizing generational wealth transfer and luxury lifestyle benefits that are often tax-deductible or non-taxable,,.

The difference between the two models is like comparing farming for a quick annual crop versus planting an ancient redwood tree: while the traditional STR model chases quick profits constrained by debt and market swings, the debt-free LAP model is engineered for perpetual growth and stability, with immediate tax benefits that accelerate wealth generation for future generations,

Информация по комментариям в разработке