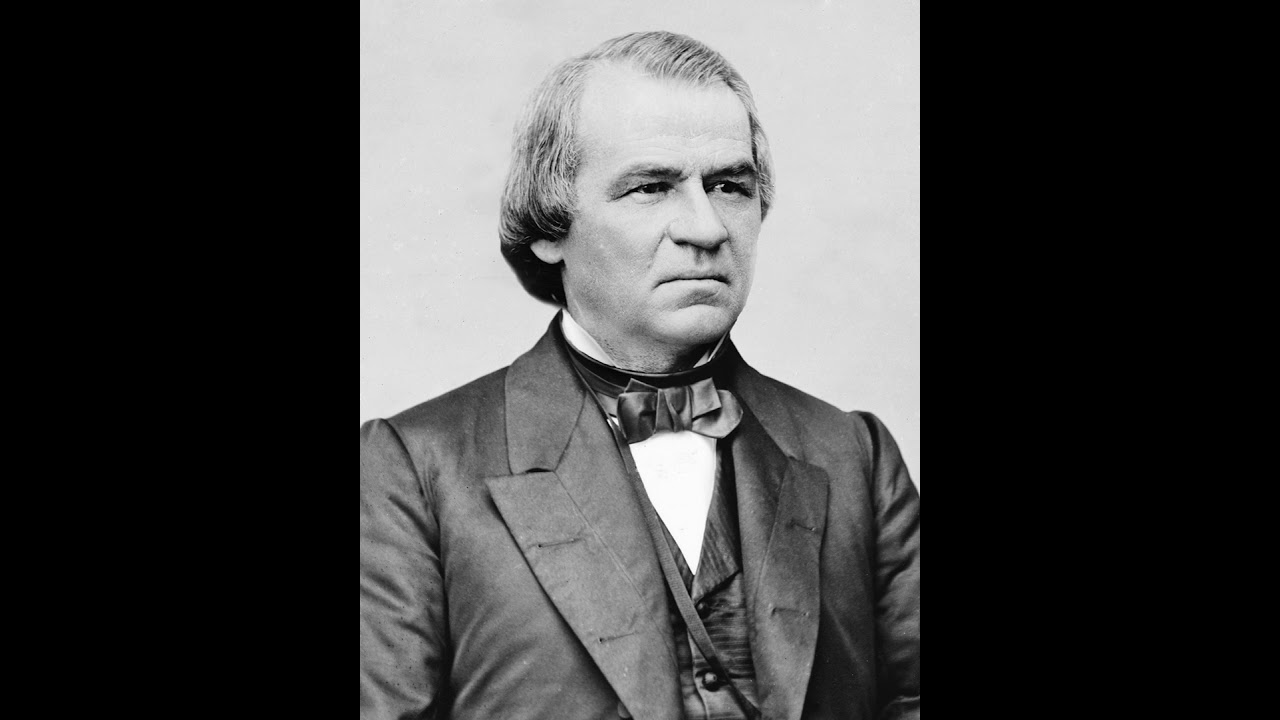

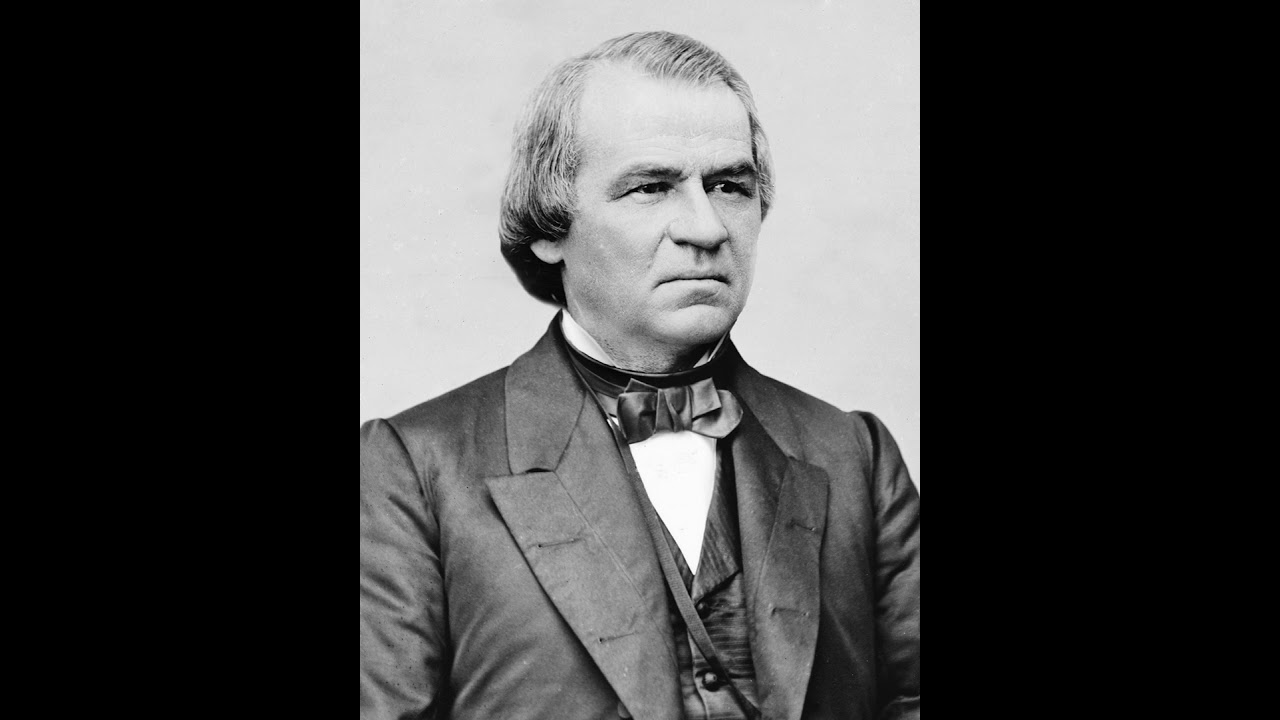

This Day in Legal History: President Johnson Vetoes Civil Rights Act of 1866

On March 27, 1866, President Andrew Johnson vetoed the Civil Rights Act of 1866, an extraordinary move that underscored his deep hostility to racial equality and his resistance to Reconstruction efforts. The bill, which Congress had passed in the wake of the Civil War, aimed to grant full citizenship to formerly enslaved people and guarantee their basic civil rights. Johnson, a Southern Democrat who remained loyal to the Union, used his veto power to block progress for freedmen, claiming the bill infringed on states' rights and unfairly favored Black Americans over whites. His justification was steeped in racism, couching white supremacy in the language of constitutional interpretation.

Johnson's veto message argued that Black Americans were not yet qualified for citizenship and that extending such rights would “operate in favor of the colored and against the white race.” He blatantly ignored the atrocities of slavery and the urgent need for federal protections, given the widespread violence and oppression freedmen faced in the South. His opposition wasn’t just a political miscalculation—it was a moral failure and a betrayal of the Union victory. Johnson actively emboldened white supremacist groups and Southern legislatures seeking to reassert control through Black Codes and racial terror.

Fortunately, Congress overrode his veto—marking the first time in American history that a major piece of legislation was enacted over a presidential veto. This moment laid the groundwork for the 14th Amendment, which enshrined birthright citizenship and equal protection under the law. Johnson’s veto, however, remains a stark example of how executive power can be wielded to delay justice and reinforce structural racism.

The Consumer Financial Protection Bureau (CFPB) plans to revoke a controversial interpretive rule that applied certain credit card protections to “buy now, pay later” (BNPL) products. This move follows a lawsuit filed by the Financial Technology Association (FTA), which represents major BNPL providers like PayPal, Klarna, Block, and Zip. In a joint court filing, the CFPB and FTA asked a federal judge to pause litigation while the agency works on rolling back the rule.

The rule, issued in May 2024, treated BNPL plans like credit cards under the Truth in Lending Act, requiring providers to offer billing statements, handle disputes, and process refunds. It officially took effect in July, but the CFPB allowed a grace period for compliance. The FTA argued the CFPB overstepped its authority by reclassifying pay-in-four products—short-term, no-interest loans—without formal rulemaking or understanding the distinct nature of BNPL.

Despite some early industry cooperation and encouragement from the CFPB for other regulators to follow suit, fintech firms claimed the rule created regulatory confusion by misapplying standards meant for revolving credit. House Republicans tried to overturn the rule legislatively last year but failed.

The case, Financial Technology Association v. CFPB, remains on hold while the CFPB prepares formal steps to rescind the rule.

CFPB Plans to Revoke Buy Now, Pay Later Rule Fintechs Fought (1) (https://news.bloomberglaw.com/banking-law/...)

A federal judge in Washington, Beryl Howell, denied the Justice Department’s attempt to disqualify her from overseeing Perkins Coie v. U.S. Department of Justice, a case challenging a Trump executive order targeting the law firm. The DOJ accused Howell of bias, pointing to remarks she made in public settings that criticized Trump and referenced his ties to Fusion GPS. In their motion, DOJ officials claimed she showed “partiality” and “animus” toward the president, citing her characterization of Trump having a “bee in his bonnet” over past political investigations.

Howell sharply rebuked the motion, calling it an “ad hominem” attack intended to undermine judicial integrity rather than engage with the legal merits. She emphasized that the parties would receive fair treatment and dismissed the disqualification effort as an attempt to preemptively discredit an unfavorable outcome.

The case stems from a Trump executive order aimed at punishing law firms perceived as politically hostile, including Perkins Coie, by restricting their federal building access and terminating government contracts with their clients. Perkins Coie argued the order caused immediate and severe business harm, including the loss of a long-standing client. Trump has since issued similar orders against other firms, such as Jenner & Block.

The DOJ’s attempt to remove Howell reflects a broader pattern of politicized efforts to delegitimize judicial rulings unfavorable to Trump. Meanwhile, a prior ethics complaint against Howell, filed by Rep. Elise Stefanik over earlier comments she made about the erosion of truth in public discourse, i...

Информация по комментариям в разработке