Course Alert:

If you would like to learn in detail, how to calculate income statement variances and the impact they have on sales $, profit $ and profit margin % and ebitda %, and how to explain performance vs budget and prior periods, click on the link for a detailed video course (at a special price). You will also learn how to analyse and present the results of the variances to management and will be able to download solved variance calculation Excel templates. https://ebitda.thinkific.com/courses/...

Looking for more personalized help?

Get in touch with me on one of these platforms:

Instagram: / learnaccountingfinance

Facebook: https://www.facebook.com/profile.php?...

Tiktok: / learnaccountingfinance

Website: https://www.learnaccountingfinance.com

Subscribe: http://www.youtube.com/c/LearnAccount...

What is gross profit and gross profit margin?

In this video, you will learn exactly how gross profit is calculated, and how gross profit margin is different from gross profit and net profit.

Some Recommendations:

Are you a First Time or New Manager? Check this out: https://amzn.to/35qWzLc

Learn pivot table data crunching business skills here: https://amzn.to/3lgYB5E

Learn all about Excel in one place: https://amzn.to/3laCXQx

Learn what financial numbers really mean here: https://amzn.to/2HPYDUI

Accounting explained in 100 pages or Less: https://amzn.to/3rCProc

00:00 What is Gross Profit margin and how is it calculated

02:06 Difference between Gross Profit and Gross profit margin

02:24 Whats included in Gross profit calculation (Net sales and cost of goods sold)

04:47 How do you interpret gross profit margin

07:38 How to calculate net profit margin

08:05 What is a good Gross profit margin %

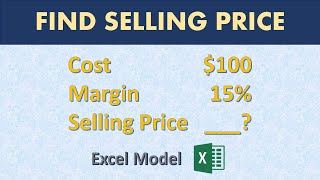

10:02 How to add margin to cost

11:07 Conclusion

What is Gross Profit?

Gross Profit is the difference between net sales and cost of goods sold for a business. It is the sales value less cost of goods sold or services provided. Gross Profit may be defined slightly differently for a manufacturing business as compared with a service or trading business. However, in principle, its calculated in the same way. It represents the profit made after deducting the costs related to the product or service from the sales value only. Note that the calculation of gross profit does not include business expenses that are not related to the purchasing of a product and delivering it to the customer. Costs related to Sales and General and admin departments for example are not included in the calculation of Gross profit.

/ learnaccountingfinance

https://www.learnaccountingfinance.com

Whats included in Gross Profit calculation?

Any deductions from sales such as discounts, rebates etc are deducted from the selling price to arrive at Net Sales value when calculating gross profit. Similarly, when calculating Cost of Goods sold, the cost of manufacturing or purchasing the product (or in the case of a service business, the cost of service delivery), are also included in the calculation of Gross profit. Transportation costs (both inbound to the business and outbound to the customer) are also included in the Cost of goods sold calculation. Similarly, any non refundable taxes and duties paid by the business are included in the cost of goods sold. If the customer of the business pays transportation, however, than the cost of such transportation is not included in the calculation of Gross profit.

While gross profit is calculated in terms of amount, gross profit margin is calculated in terms of percentage, and the formula for calculating gross profit margin is Gross Profit divided by Net Sales, multiplied by 100. Gross Profit margin is also often referred to as Gross margin, Gross Profit percentage, Gross profit ratio and Gross profit to Net Sales ratio.

Difference between Gross Profit margin and Net profit margin

While gross profit and gross profit margin deal only with costs of manufacturing, purchasing or delivering the product, net profit and net profit margin also consider all other business operating expenses such as costs of Sales department, IT, Finance, HR and other administrative expenses. Net profit margin is calculated in the same way as gross profit margin. The only difference is that the numerator is changed by Net profit instead of Gross Profit. Denominator remains same.

What is a good Gross profit margin

Generally, a high gross profit margin is desirable, so the higher the margin percentage the better. However, an important factor to keep in mind is that ultimately, what is more valuable is the amount of profit made by the business. So, if gross profit margin is very high as a result of higher prices compared to competition, and it results in lower sales, then it may be so that by reducing the price and increasing the quantity of sales, the business may end up with higher gross profit or net profit.

Информация по комментариям в разработке