The Vanguard Small Cap Value ETF, ticker symbol VBR, is an exchange-traded fund that invests in a broad and diverse range of small-capitalization value stocks. This ETF is designed to provide investors with exposure to a portfolio of small companies that are undervalued relative to their earnings, dividends, or book value, and are considered to have the potential for long-term growth.

Vanguard is one of the largest and most well-known investment management companies in the world, and its ETFs are known for their low fees and broad market exposure. The Vanguard Small Cap Value ETF is no exception, offering a low-cost and efficient way to gain exposure to the small-cap value segment of the stock market.

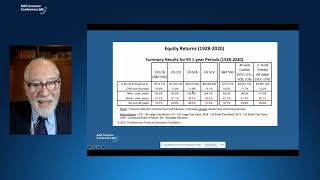

One of the key benefits of investing in small-cap value stocks is the potential for outperformance compared to the broader stock market. Historically, small-cap value stocks have tended to provide higher returns over the long-term than other segments of the market, and they can be a valuable addition to a diversified investment portfolio.

Investing in small-cap value stocks can also provide investors with exposure to companies that are on the cusp of growth and may be more likely to experience significant upward price movements. In addition, because small-cap value stocks are often underfollowed by analysts and institutions, they may be more likely to be mispriced, providing opportunities for savvy investors to take advantage of undervalued assets.

The Vanguard Small Cap Value ETF tracks the CRSP US Small Cap Value Index, which is designed to provide a broad representation of the small-cap value segment of the US stock market. The index is market capitalization weighted, meaning that larger companies have a greater impact on the index's performance. As of 2021, the ETF holds over 600 individual stocks, and its top holdings are companies in the financial services, healthcare, and technology sectors.

In terms of fees, the Vanguard Small Cap Value ETF is among the lowest-cost options in its category, with an expense ratio of just 0.08%. This low fee structure helps to keep more of an investor's returns, making the ETF an attractive choice for cost-conscious investors.

In terms of performance, the Vanguard Small Cap Value ETF has outperformed its benchmark index over the long-term, and has provided investors with positive returns in most market environments. However, it is important to note that all investments come with risks, and small-cap value stocks can be more volatile than other segments of the market.

In conclusion, the Vanguard Small Cap Value ETF provides investors with a low-cost and efficient way to gain exposure to the small-cap value segment of the stock market. By investing in a broad and diverse range of undervalued small companies, the ETF can offer the potential for long-term growth and outperformance compared to the broader market. However, as with all investments, there are risks involved, and it is important to carefully consider one's investment objectives and risk tolerance before making any investment decisions.

Информация по комментариям в разработке