In this video, titled "O Level Accounting Topical Past Paper Solution - 7707 Paper 21 May/June 2024 - Q3 (d) Decision Making," I delve into strategic decision-making and company expansion for Q Limited. Zahra and Panya, the directors and shareholders, are considering a 100% increase in advertising expense to boost company sales as part of their expansion strategy. In this solution, I explore both the potential benefits and risks of this decision, providing insight into how to increase sales effectively. Here’s the detailed question for reference:

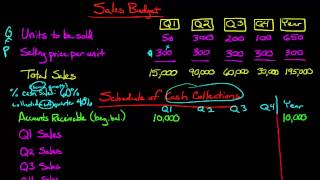

Q Limited Trial Balance at 31 January 2024

Debit Side:

Purchases: $38,200

Rent and insurance: $10,600

Directors’ salaries: $19,000

General expenses: $3,420

Advertising: $5,400

Dividends paid: $2,500

Fittings at cost: $18,000

Inventory at 1 February 2023: $2,950

Cash at bank: $915

Credit Side:

Revenue: $78,000

Provision for depreciation of fittings: $5,400

Trade payables: $2,288

Ordinary share capital: $13,000

Retained earnings: $2,297

Additional Information:

1. Inventory at 31 January 2024 was valued at $4,720.

2. Depreciation on fittings is charged at 10% per annum using the straight-line method.

3. Payment for advertising, $75, is outstanding at 31 January 2024.

4. No dividends were outstanding at 31 January 2024.

Zahra and Panya would like to expand the company and increase sales. To do so, they are considering a 100% increase in the amount spent on advertising.

(d) Advise Zahra and Panya whether or not they should go ahead with the 100% increase in the amount spent on advertising. Justify your answer by providing two points in favour and two points against this increase.

I regularly provide solved past papers and academic lectures across multiple boards, including I Com, B Com, IGCSE, CAIE, GCSE, and Edexcel. My channel, Tutoring at Home with Sir Imran Badar, offers comprehensive accounting solutions, focusing on core topics like errors of omission, financial statement analysis, and accounting principles. Be sure to subscribe and turn on notifications to stay updated with the latest exam solutions and tutorials designed to help you excel in your studies.

Follow me on TikTok

https://www.tiktok.com/@ib_jee?_t=8qA...

For more videos on decision making and suggestion videos:

https://studio.youtube.com/playlist/P...

If you're looking to excel in IGCSE Accounting past papers and want expertly crafted solutions for CAIE papers solved, our resources for O Level Accounting past papers offer just what you need. From the latest Edexcel IGCSE Accounting past papers to comprehensive guides on the CAIE exam, this platform ensures you're well-prepared for your IGCSE revision and Accounting O Level revision. We cover the essential materials for O Level exams, including the 7707 past paper 21, and various formats like Accounting O Level 7707 past papers and O Level 7707/21/21/11/12.

Our detailed approach to O Level Accounting Paper 7707 ensures that students gain a solid understanding of key concepts, providing step-by-step solutions for both IGCSE Accounting and related accounting lecture topics. The focus is always on ensuring mastery of Accounting O Level past paper questions through in-depth solution videos. Whether you're preparing for your CIE exam or working closely with CIE tutors, this Accounting YouTube channel is designed to enhance your learning experience.

By offering solutions to previous year paper questions, we aim to simplify CIE preparation, making sure you're ready for the Accounting O Level Cambridge assessments. Our detailed coverage of 7707 questions and answers is particularly useful, and we also provide solution lectures in both Urdu and Hindi, helping students from diverse backgrounds. So, if you’re searching for effective strategies and detailed answers to solution questions, our platform ensures you have the tools to succeed.

#tutoringathome #imranbadar #sirimranbadar

Информация по комментариям в разработке