Modern economies rely on three capital forms — debt, equity, and grants — whose logics of extraction, liability, and depletion make them structurally incompatible with long-horizon public goods.

In this video, we introduce Regenerative Economic Architecture (REA) — a macroeconomic framework developed by the @irsa-institute that explains why contemporary economic systems systematically fail in domains like climate adaptation, health infrastructure, scientific capability, and community resilience — even when funding levels are high.

The core insight is architectural:

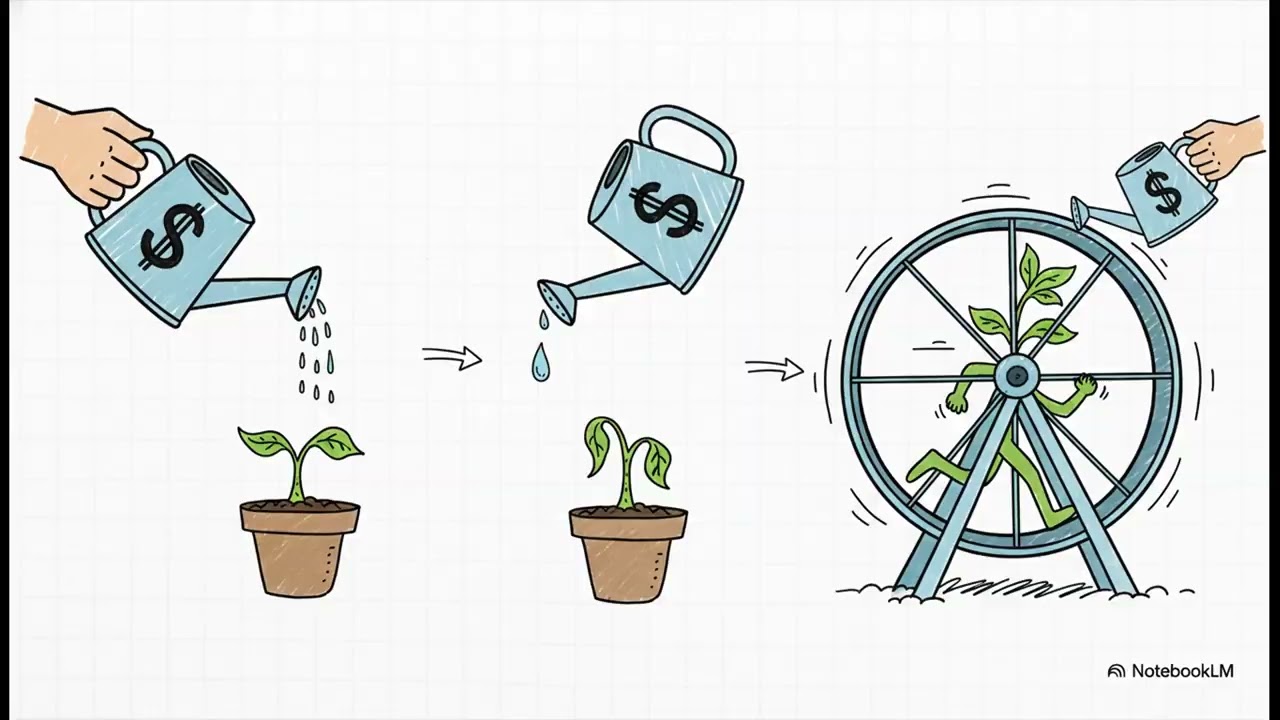

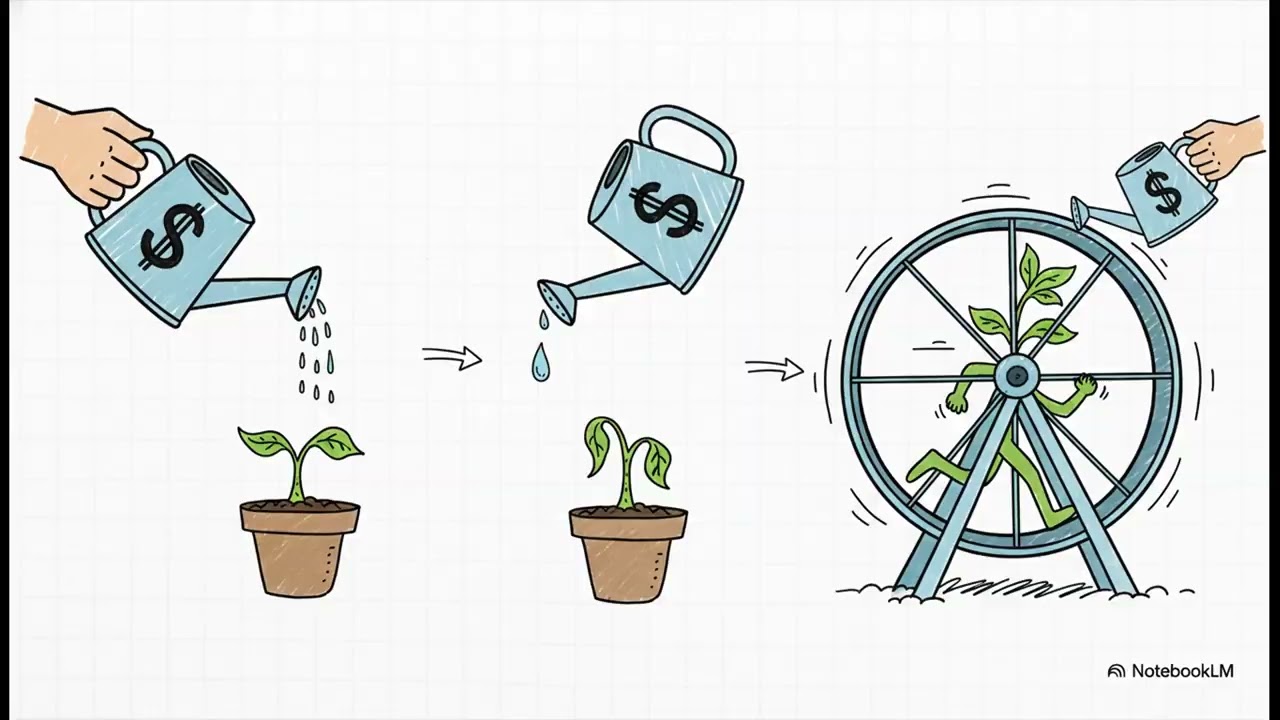

the problem is not how much capital we deploy, but how capital behaves across time.

REA shows that debt, equity, and grants are not neutral tools. Each hard-codes temporal and behavioural dynamics that produce fragility, governance distortion, or capital collapse when applied to long-horizon systems.

Regenerative Economic Architecture identifies a missing fourth capital class — non-liability, non-extractive, multi-cycle regenerative capital — and develops the macroeconomic conditions under which it can operate at institutional, sectoral, sovereign, and global scale.

In this explainer, we cover:

Why debt, equity, and grants fail deterministically in long-horizon systems

The historical trichotomy of capital — and the missing quadrant

Why “patient capital”, blended finance, and ESG cannot solve the problem

The four structural invariants of regenerative capital: R — recycling (capital continuity), γ — capability return (non-financial regeneration), Δ — decoupling from fragility cycles, Λ — alignment with mission cycles

How regenerative systems compound 20–100× through temporal recurrence rather than interest or extraction

The concept of the cycle constitution — a constitutional layer that protects time, not power

How regenerative capital scales from institutions to national and global systems

Why regenerative capital becomes economically dominant in shock-prone domains

Regenerative Economic Architecture is not a reform of capitalism.

It is an expansion of economic space — introducing a new mode of capital behaviour that preserves capability, absorbs shocks, and compounds across decades without extraction.

This framework explains how a post-extractive economic system can exist without abandoning markets, discipline, or coordination — by redesigning capital itself.

🔗 Full explainer:

https://irsa.institute/explainer/rege...

📄 Research paper (PDF):

Towards a Regenerative Economic Architecture: Scaling Non-Extractive Capital Beyond Debt, Equity, and Philanthropy

🏛 Institute for Regenerative Systems Architecture (IRSA):

https://irsa.institute

📚 Explore the full IRSA framework stack:

https://irsa.institute/explainer

This channel explores how economies can be architected to preserve capability across time — replacing extraction, depletion, and fragility with regeneration and continuity.

#RegenerativeEconomics #CapitalArchitecture #Macroeconomics #InstitutionalDesign #PublicFinance #SystemsArchitecture #RegenerativeCapital

Информация по комментариям в разработке