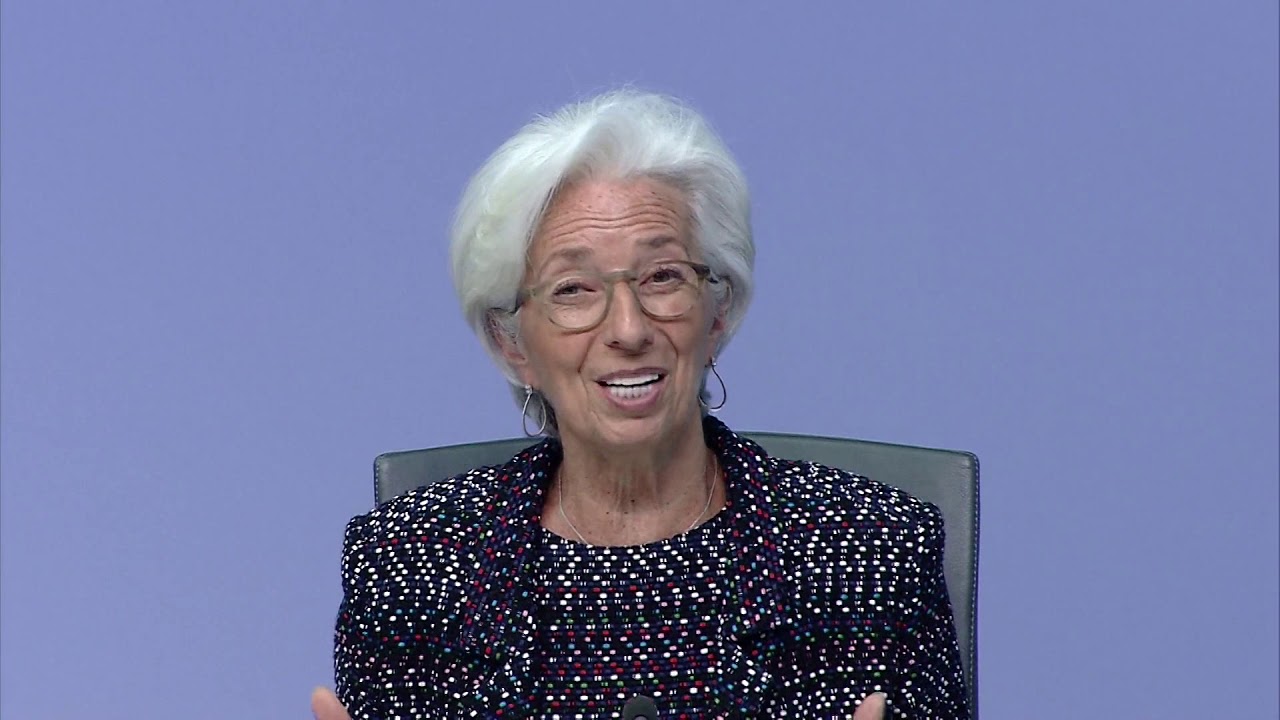

ECB Steps Up Crisis Aid as Lagarde Demands Government Action.

#ECB Press Conference #Lagarde #eudebates #Economy #ECON #Eurozone #Euro #ESM

Christine Lagarde / President of the European Central Bank

Outright Monetary Transactions OMT is a program of the European Central Bank under which the bank makes purchases ("outright transactions") in secondary, sovereign bond markets, under certain conditions, of bonds issued by Eurozone member-states.

I am going to take the opportunity of this first question to take you back a little bit to the last two days that we've had with Governing Council members. I also want to take this opportunity to walk you through the masses of changes that the Eurosystem and the ECB together have decided and, for most of them actually now, implemented in the last few weeks. In terms of the current situation, we are facing an economic contraction of a magnitude and speed that is unprecedented in recent history. The spread of the coronavirus and the associated containment measures have literally halted economic activity to a large extent across the globe. We are seeing a rapid evolution of the economic effects of the necessary containment measures in our area. Initially there were only some sectors that were badly affected. We were talking about transportation, we were talking about tourism, we were talking about entertainment. Gradually as the containment measures took hold, entire sectors of the economy to a large extent were simply shut down.

...

Now, let me turn to the number of measures that we have taken since March. All those measures are aimed at 1) ensuring ample liquidity conditions 2) protecting the smooth flow of credit to business and households and 3) preserving highly-accommodative financing conditions. Those are the three goals we're pursuing. There is the pandemic emergency purchase programme, €750 billion, combined with our increased APP decided on the 12th March – €120 billion combined with our monthly purchases of €20 billion monthly. We have over €1 trillion that we can deploy and use until the end of the year to purchase assets. Our new targeted lending facility provides for around €3 trillion in liquidity to banks at a negative rate. This rate can be significantly below our policy rate. Third, we have also significantly eased our collateral rules to ensure that banks can continue to make use of the refinancing facilities, ensuring that our monetary policy tools remain effective even in times of severe financial market stress, and against the backdrop of looming rating downgrades.

These operations will be carried out as fixed-rate tender procedures, with full allotment, at an interest rate that will be 25 basis points below the average main refinancing operation rate or MRO rate. The Governing Council – and we discussed that over the last two days – is more determined than ever to strengthen its commitment, to ensure supportive financial conditions across all sectors and countries so that they can absorb this unprecedented shock that we are experiencing. With this in mind, we will make full use of the flexibility that is embedded in PEPP and in other components of our policy toolkit to ensure that our monetary policy stance reaches all sectors and countries in the same manner.

I'm saying all that to you to address your questions because as one of the decisions that we made and that I just commented, we decided to enlarge the pool of collateral by effectively freezing ratings where they were on April 7th. We provided for a floor which is at CQS5, but that gives a large pool from which banks can actually draw in order to get financing. We did not discuss the APP. Let me remind you that again we are fully flexible, we will look at all options, we will determine and monitor and we will make sure that our monetary stance and our monetary policy transmission are both effective.

Your second question dealt with OMT. Now, let me remind you that OMT was conceived back in 2012 and there was full publication about the terms and conditions and characteristics of OMT. OMT was intended for particular country cases and particular circumstances where, because of fiscal policy or structural policy misguidance, there was a potential risk out there that the euro area be at risk and that it would be self-fulfilling. Those were the days. We are no longer facing that situation. We are facing a situation where it's not a single country, but it's all countries, where it's a global shock that applies in a very symmetric way. The best tool that we have in our toolbox is indeed the Pandemic Emergency Purchase Programme, PEPP.

Now, of course OMT remains part of the toolbox and we are not suggesting that we would eliminate OMT, but for the crisis we're going through at the moment, PEPP is clearly designed to that effect, added to which the triggering of OMT of course is a matter for the Governing Council to decide. I think I've dealt with your two questions.

Информация по комментариям в разработке