LEXA Ledger is the operating system for digital loans.

Loan markets today still run on documents, spreadsheets, emails, and manual trust. Yet loans themselves are not static contracts — they are living systems that evolve continuously through amendments, covenant tests, servicing events, trading decisions, and ESG obligations. As complexity increases, institutions struggle to maintain a single, trusted view of loan state, risk, and readiness.

LEXA Ledger was built to solve this exact problem.

Rather than treating loans as PDFs stored in folders, LEXA Ledger treats each loan as a living digital system whose facts, obligations, intelligence, and audit history stay connected throughout its entire lifecycle.

The Problem

Across banks, agents, trustees, and secondary market participants, critical questions remain difficult to answer:

What obligations are coming due across the portfolio?

Why is a specific loan considered trade-ready or risky?

What changed in the loan, when did it change, and who accessed it?

Can decisions be explained to auditors, regulators, or investors?

Today, answering these questions requires manual reconciliation across disconnected tools. This creates operational risk, slows secondary trading, increases compliance burden, and undermines trust.

The Solution

LEXA Ledger is a desktop-first and web-based enterprise platform that connects the full loan lifecycle into one coherent, explainable system:

Documents → Structured Facts → Living Loan → Explainable Intelligence

The platform brings together:

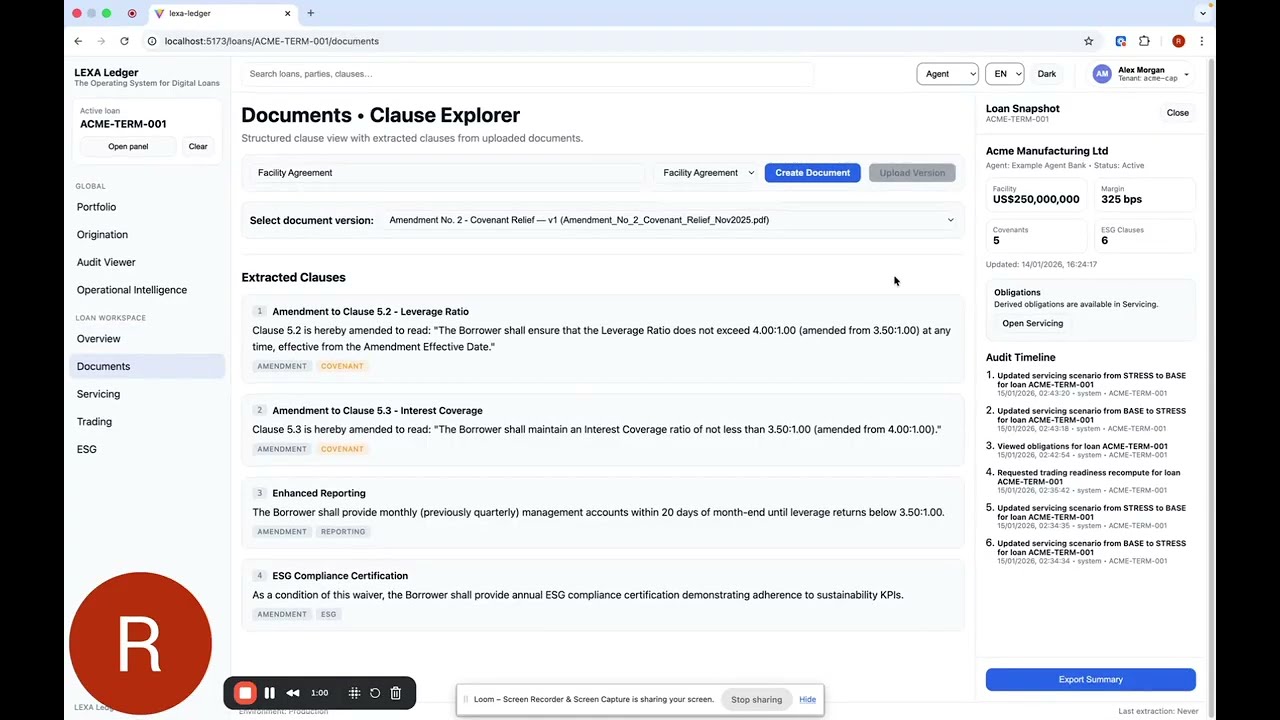

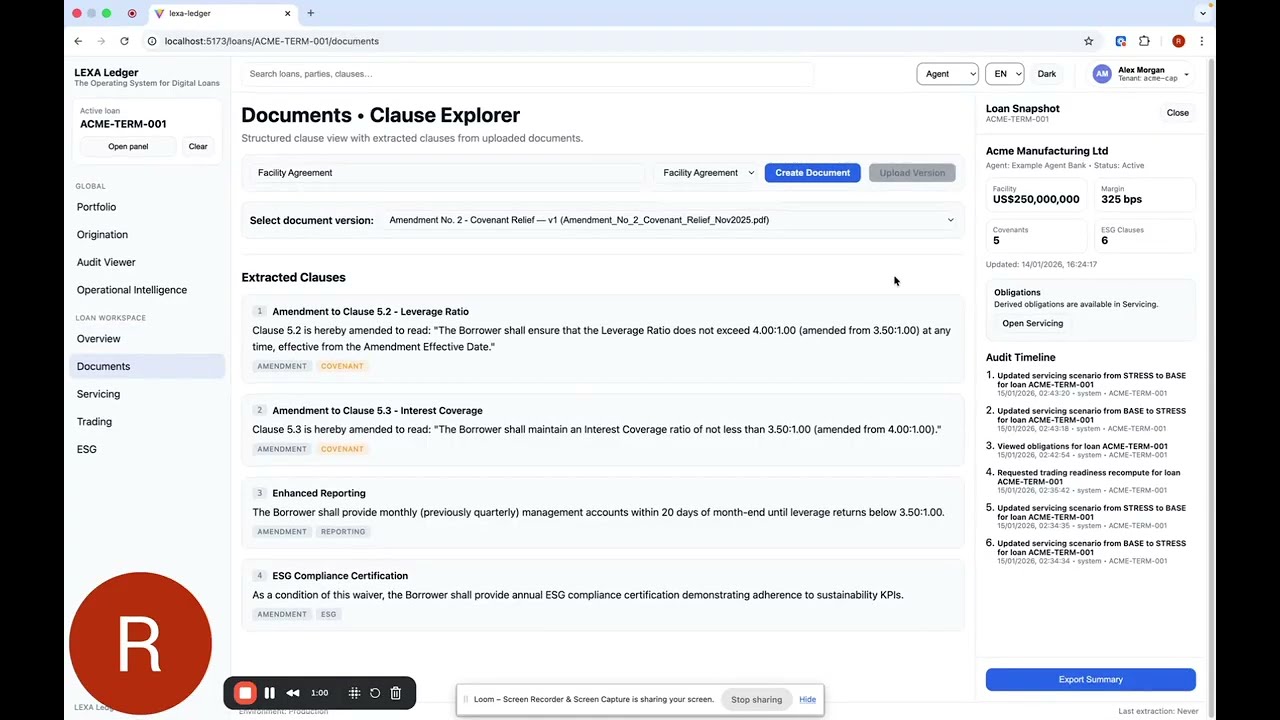

Documents & Amendments

Loan agreements and amendments are structured into machine-readable facts that become the upstream source of truth for all downstream activity.

Servicing & Obligations

Covenants are monitored continuously, and obligations are derived automatically from documents, covenants, and ESG cadence — eliminating manual tracking.

Trading Readiness

Loans are assessed for secondary market readiness using explainable, facts-first intelligence that highlights blockers and remediation steps.

ESG Tracking

ESG KPIs, evidence, and verification states are tracked alongside financial obligations, reflecting modern lending realities.

Portfolio Intelligence

Portfolio-level rollups surface exposure, risk distribution, ESG posture, and upcoming obligations across all active loans.

Audit & Compliance

Every action — including AI explanations — is captured in a complete, immutable audit trail.

Explainable Intelligence — Not Black-Box AI

LEXA Ledger deliberately avoids opaque automation.

AI is used only to explain, summarize, and recommend, never to overwrite verified loan facts or make autonomous decisions. Every explanation is grounded in structured data, validated against schemas, and recorded in the audit log with full traceability.

This ensures intelligence is:

Explainable

Reproducible

Regulator-safe

Trusted by human decision-makers

Enterprise-Grade by Design

LEXA Ledger was built production-first, not demo-first.

Key enterprise capabilities include:

Role-based access control across all modules

Strong tenant isolation with zero cross-tenant data leakage

Secure authentication using industry-standard identity protocols

Encrypted desktop token storage for native deployments

Rate-limited and hardened APIs

Asynchronous processing for recompute and drift detection

End-to-end audit coverage across UI, backend, workers, and AI calls

The system is designed to meet the expectations of banks, regulators, and institutional users from day one.

Why It Matters

LEXA Ledger does not replace judgment — it strengthens it.

By keeping loan facts current, decisions explainable, and actions auditable, the platform reduces operational risk, accelerates trading workflows, simplifies compliance, and builds trust across the loan ecosystem.

Judges, investors, and industry practitioners consistently recognize LEXA Ledger as something they could use immediately, not a hypothetical future concept.

Current State

LEXA Ledger is a fully working system:

Web and native desktop applications

End-to-end loan lifecycle implemented

Derived obligations visible in servicing

Explainable trading readiness live

Portfolio-level intelligence available

Exportable, compliance-ready summaries

Production-grade security and audit in place

This is not a mock-up or slideware — it is a functioning platform.

Vision

LEXA Ledger aims to become the system of record for living loans.

A future where:

Loan facts stay current automatically

Информация по комментариям в разработке