2025: You tap phone, pay $6 for coffee. Bank sends electronic message: "reduce this account by $6, increase that by $6." No money moved. Numbers changed in databases. The $6 doesn't physically exist.

1825: Same transaction. You hand merchant silver coin (0.77 oz pure silver). He verifies real metal. You've paid with actual physical metal having intrinsic value.

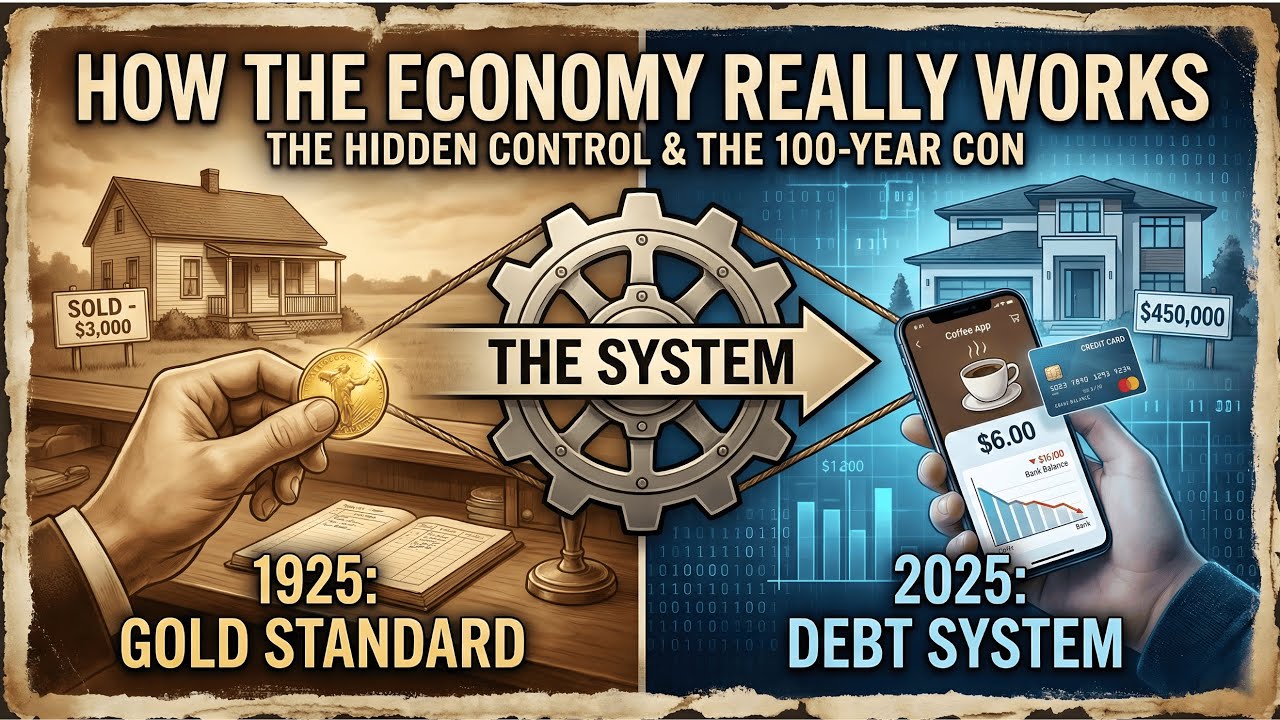

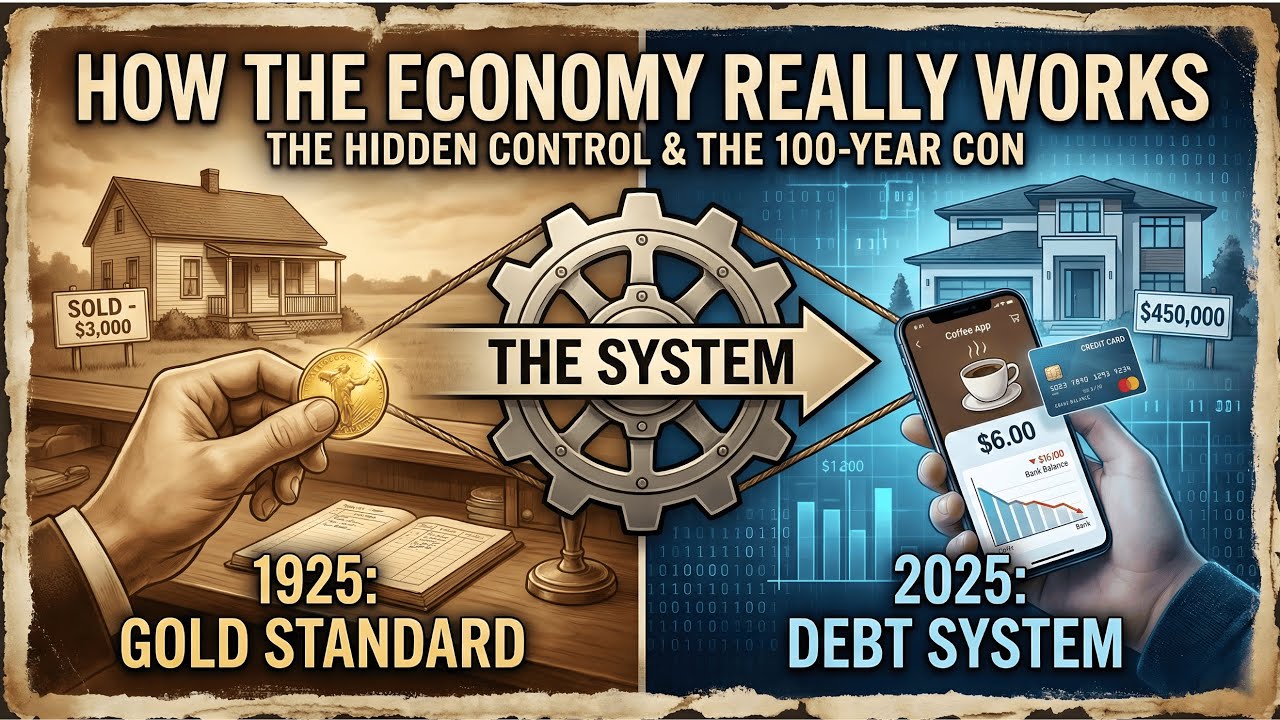

200 years apart. Reveals fundamental difference: Old economy based on tangible value. Modern economy based on debt, trust, numbers in computers.

OLD ECONOMY (Until ~1971):

Money was store of value backed by gold/silver

Economic growth limited by physical constraints

Couldn't create money from nothing

Ancient Rome: Denarius was silver coin. Soldier paid 225 denarii/year. Real value. Government couldn't create value from nothing. Had to mine silver.

Price stability: England, wheat cost 5 shillings (1300), 6 shillings (1700). 400 years, minimal inflation because money supply grew slowly.

THE TRANSITION:

WWI (1914): Governments suspended gold convertibility to print money for war.

1933: Roosevelt made owning gold ILLEGAL. Confiscated at $20.67/oz, revalued to $35/oz (41% wealth theft). Gold was obstacle to monetary manipulation.

Bretton Woods (1944): Dollar pegged to gold at $35/oz. Other currencies pegged to dollar.

August 15, 1971: Nixon suspended gold convertibility "temporarily." Became permanent. Gold standard died. Modern monetary system born.

MODERN ECONOMY (Post-1971):

Fiat currency: Has value because government declares it and people trust. No gold. No silver. Just government decree and collective belief.

Debt-based: Most money created by banks through lending (fractional reserve banking).

Example: Deposit $1,000. Bank keeps $100 reserves, loans $900. Borrower has $900. You still have $1,000 in account. Money supply just became $1,900 from original $1,000. Extra $900 created from nothing.

Process repeats: That $900 deposited elsewhere, bank keeps $90, loans $810. Now $2,710 exists from original $1,000.

~97% of money exists as bank credit, not physical currency. When you get $300K mortgage, bank creates $300K by typing numbers. Didn't exist before. You now owe $300K + interest.

IMPLICATIONS:

Modern economy requires perpetual growth. Lending stops = money supply contracts = recession. System designed to expand continuously or crash.

Old vs Modern mindset:

Old: Production and savings (make things, save for investment)

Modern: Consumption and debt (buy stuff with borrowed money to drive GDP)

Consumer debt: Credit cards $1.17T (22% avg rate). Auto loans $1.63T. Student loans $1.77T. Mortgages $12.5T. Total household debt $17.9T.

HOUSE EXAMPLE:

1925: Worker earned $1,500/year. House cost $3,000 (2X income). Saved for down payment, got 5-10 year mortgage with 50% down. Paid off in 10 years.

2025: Worker earns $75,000/year. House costs $450,000 (6X income—triple the ratio). Needs $90K down payment. Gets 30-year mortgage at 6.5%. Pays $450K principal + $580K interest = $1,030,000 total. Pays until age 65.

Why? 1925: Sound money, limited credit, local production. 2025: Fiat currency, unlimited credit, inflated asset prices (loose monetary policy allows buyers to borrow more = drives up prices).

WHAT IT MEANS:

Saving currency = losing strategy (dollars lose 3-7% annually to inflation, 60% over 30 years)

Own productive assets (stocks, real estate, commodities can't be printed)

Debt benefits borrowers in inflation (borrow in expensive dollars, repay in cheap dollars)

System transfers wealth upward (Fed prints → banks/corps get first → buy assets → prices rise before money reaches workers = Cantillon Effect)

Modern economy needs continuous credit expansion + cheap energy to function

FUNDAMENTAL SHIFT:

Old: Money backed by tangible value, growth limited by production

Modern: Money backed by debt, growth driven by consumption

Your grandparents could save money and preserve wealth. You cannot. Must invest in assets that appreciate with inflation or get poorer despite saving.

Not financial advice. Educational explanation of how two fundamentally different economic systems operate and what it means for building wealth in modern economy.

Информация по комментариям в разработке