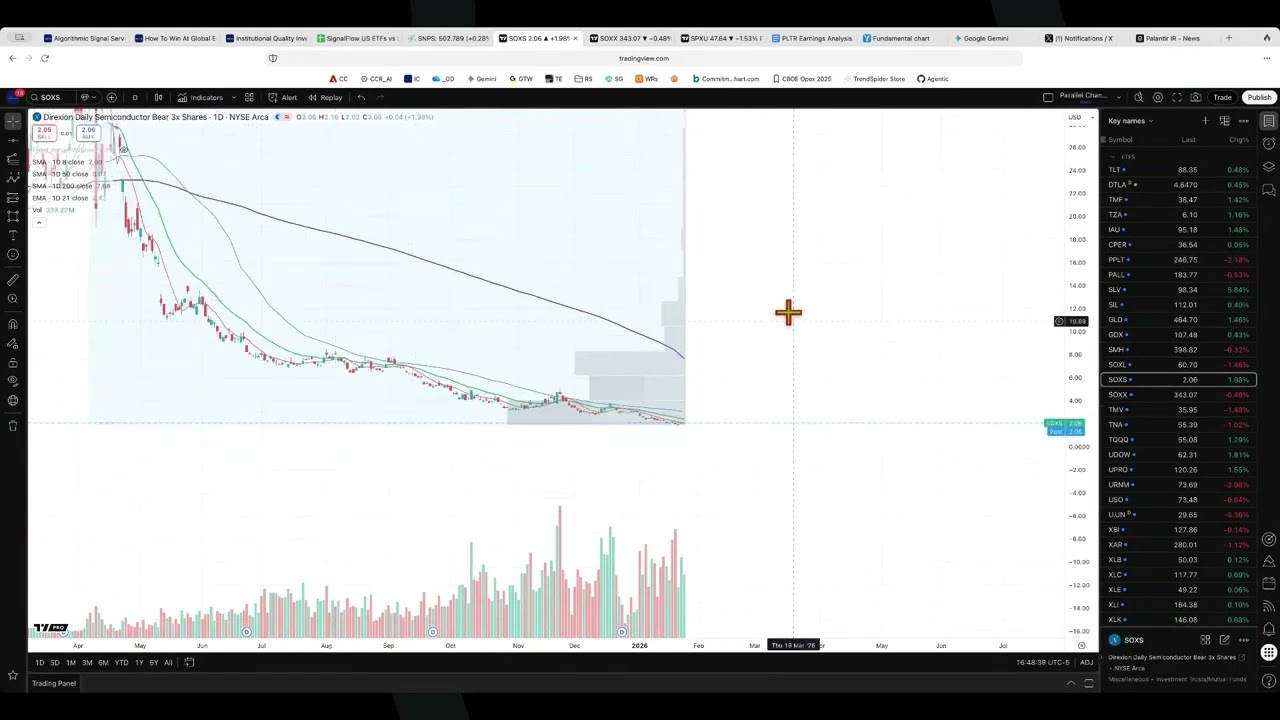

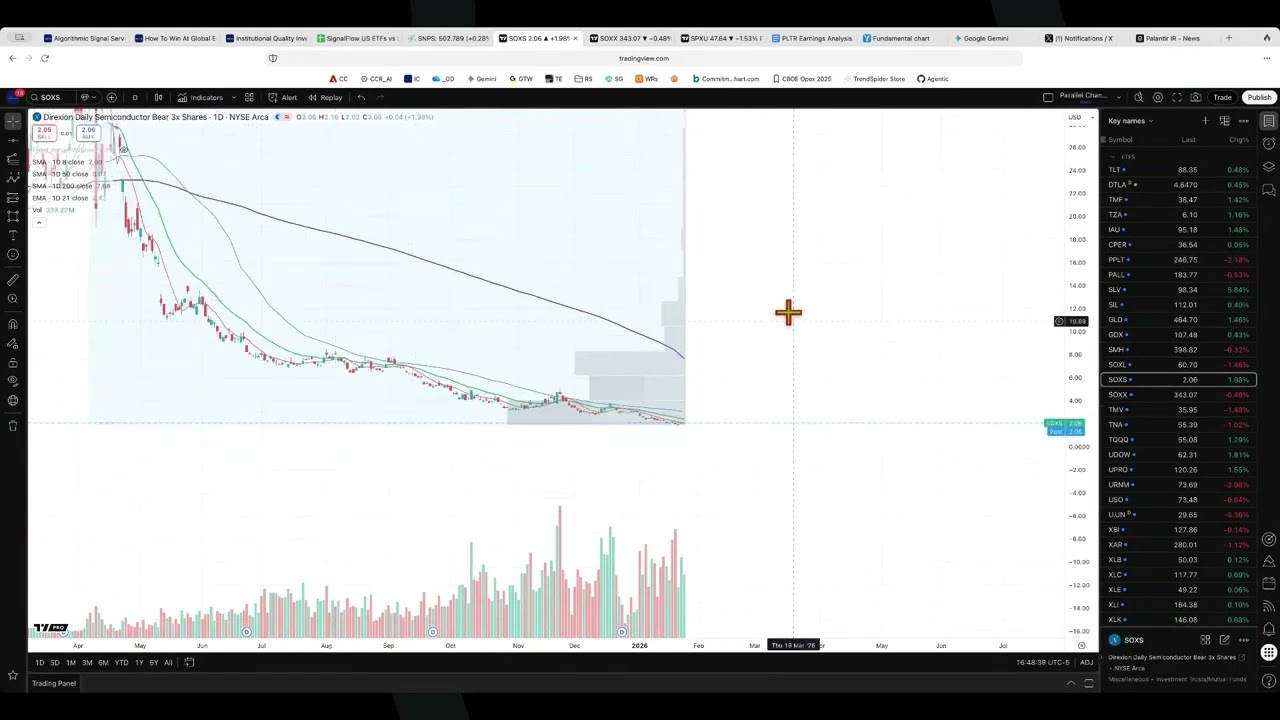

Semiconductor sell-off risk may be rising, and Alex King is watching the “tell” in $SOXS.

In this video, Recorded Jan 26th, 2026 Alex King (Cestrian Capital Research) explains why the inverse semiconductor ETF $SOXS is starting to show bottoming behavior, and how that can coincide with profit-taking pressure in semiconductor leaders. He also highlights volume-by-price as a potential window into institutional hedging and positioning, plus a sector rotation view that suggests leadership may be starting to shift.

Key points covered:

• Why a $SOXS bottoming setup can signal increasing downside risk for semiconductors

• How deceleration and a rounding profile can precede a reversal

• What volume-by-price may indicate about institutional activity

• Why rotation can follow extended outperformance in chips

• A related risk setup using $SQQQ vs. $QQQ for broader context

Tickers discussed: $SOXS $SOXX $QQQ $XAR

semiconductor sell off, semiconductor selloff, semiconductor stocks, semiconductors, SOXX, SMH, SOXL, SOXS, Nasdaq, QQQ, SQQQ, sector rotation, market rotation, institutional hedging, volume by price, technical analysis, chart analysis, trend reversal, momentum, profit taking, risk management, market commentary, trading strategy, investing strategy, Cestrian Capital Research, Alex King, ETF analysis, stock market analysis

➡️Follow us on:

X: https://x.com/CestrianInc

BlueSky: https://bsky.app/profile/cestrianinc....

StockTwits: https://stocktwits.com/CestrianCapita...

Linkedin: / cestriancapitalresearch-inc

➡️ DISCLAIMER ❗️❗️ This video is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this video is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this video is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this video. Any opinions, analyses, or probabilities expressed in this video are those of the author as of the video's date of upload and are subject to change without notice. Companies referenced in this video or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Информация по комментариям в разработке