VPT Model and Analysis of Silicon Valley Economic History From 1991 to 2025 (No.1435, VPT #008, 11/12/2025)

Gerald C. Hsu

EclaireMD Foundation

Category: Economics

Preface

Before analyzing Silicon Valley as an economic system, I lived inside its engine. From 1979 to 1988, I pursued startups in personal computers, CAD software, and AI algorithms, failing seven times due to limited funding or ideas ahead of available hardware, including a 1983 concept resembling today’s “ChatGPT.” From 1988 to 1990, I worked on GPU software at Sun Microsystems and sold GPU inventions to Kodak, Xerox, and Canon, enabling early intelligent devices.

In 1991, I became IC Division President at Cadence and later founded Avant! Corporation, advancing semiconductor design from manual layout to algorithmic automation. My placement and routing algorithms, originating from training at the University of Iowa and MIT under Patrick Winston, later inspired parallels with neuroplasticity. Avant! expanded into AI chip design by 1998. Severe business pressure and a hostile lawsuit caused three heart attacks, leading me to sell the company to Synopsys in 2002. My collapse coincided with the dot-com crash, illustrating that biological and economic systems fail once accumulated energy exceeds elastic limits.

In 2025, I returned as a medical research scientist applying Viscoplastopology (VPT), integrating viscoplastic theory and topology learned from Norman Jones, KH Ting, and UC Berkeley.

Introduction

Silicon Valley behaves like a viscoplastic system: elastic during expansion, hardened under pressure, and permanently deformed beyond yield. This study treats the economy as a structure governed by the same physical laws as engineering materials and biomedical tissues. Three deformation cycles appear between 1990 and 2025: dot-com rise and collapse, recovery from mobile and cloud technologies, and AI-driven expansion followed by slowdown from interest-rate increases and AI-induced layoffs.

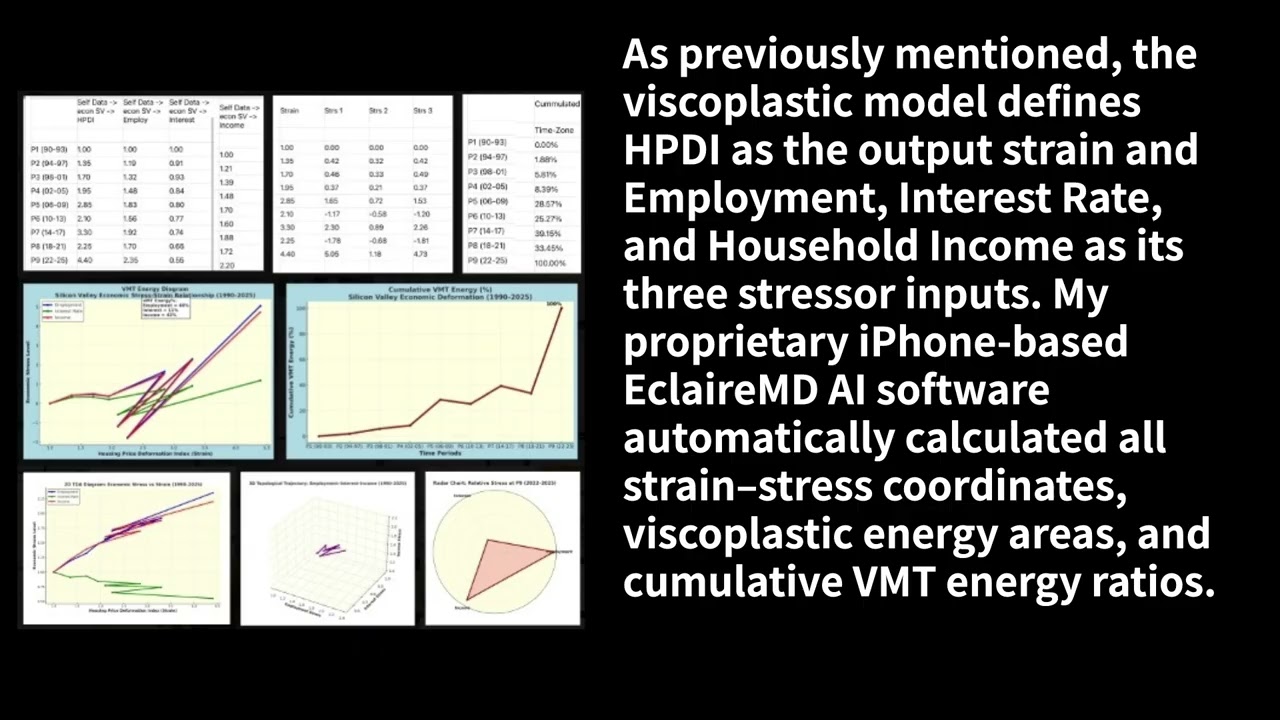

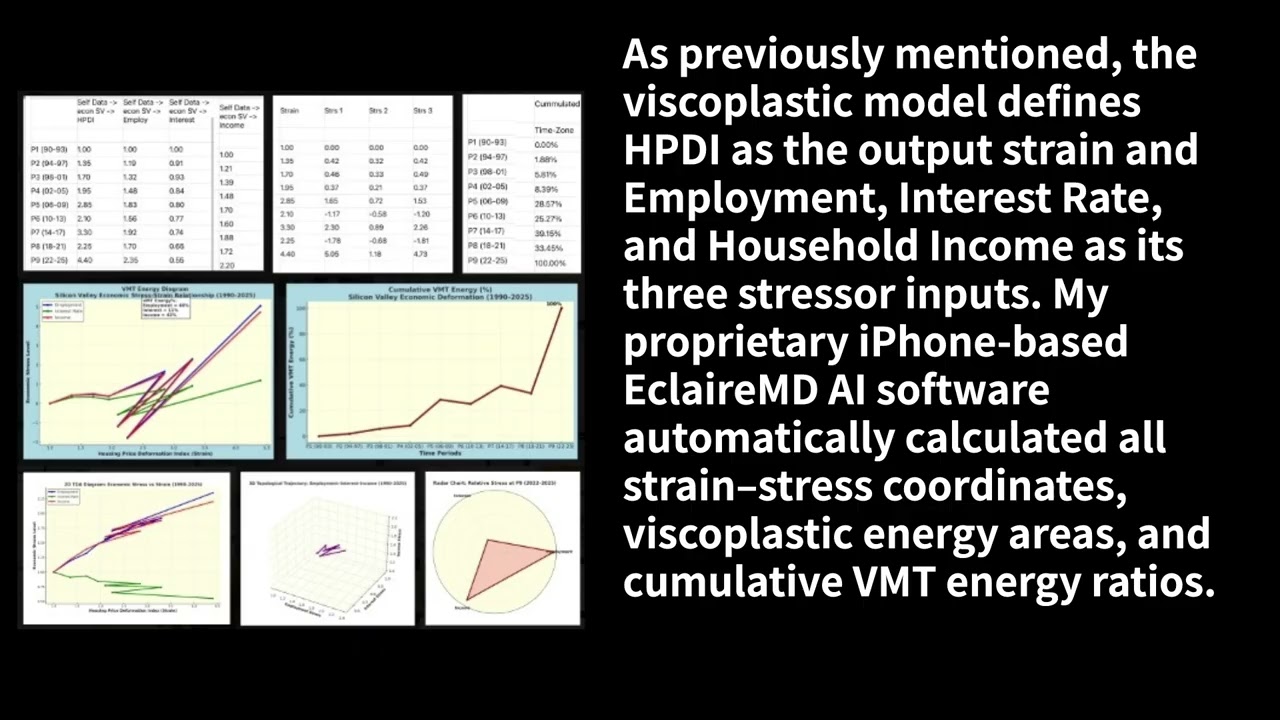

VPT combines VMT to quantify cumulative deformation energy and TDA to examine geometric change. Economic strain is measured by the Housing Price Deformation Index (HPDI) with stressors of employment, interest rate, and income. HPDI reveals tensions between affordability, productivity, and financial pressure, tracing a 36-year stress–strain path.

VMT Interpretation

VMT shows irreversible deformation from cumulative stress across nine 4-year periods. Total deformation energy reaches 100% by Period 9. Stressor contributions are: Employment 46%, Interest 11%, Income 43%, indicating dominance of human productivity. Mechanical phases include elastic expansion (1990–2005), yield (2006–2013), hardening (2014–2021), and structural transformation (2022–2025). Employment acts as tensile stress, income as bonding, and interest as compressive resistance.

Universal Behavior

Silicon Valley follows nonlinear, path-dependent laws similar to physiology, metallic fatigue, and psychological adaptation. Once yield occurs, only reconfiguration is possible; residual deformation remains.

Toward Viscoplastic Economics

Stress, strain, deformation, and dissipation unify economics with physics, revealing irreversible evolution.

VMT Conclusion

Silicon Valley’s economy is path-dependent and irreversible. The 2022–25 phase represents a hardened system, less elastic than in earlier decades.

TDA Interpretation

TDA maps nine periods in a 4D space. Employment and income rise with strain while interest declines, producing geometric inversion. PCA identifies employment–income as the dominant axis. Topology transitions from expansion to divergence, contraction, and final hardening, with the 3D manifold contracting toward a 2D sheet.

VPT Alignment and Final Conclusion

VMT energy ratios match TDA geometry. Both show Silicon Valley as a viscoplastic system shaped by irreversible energy accumulation, with employment and income as primary drivers and interest as a minor damping force. VPT Economics integrates physics, mathematics, engineering, biomedicine, psychology, and macroeconomics.

Disclaimer

I write this paper not for fame, but to share what I have learned so others can understand their health, prevent disease, and live longer, healthier lives. This content is provided for educational reference only and does not constitute medical or financial advice. No doctor–patient or advisor–client relationship is created. You may share this summary freely, but it must not be altered, edited, or republished as your own. All intellectual property rights and copyrights for this article and its related materials belong to the author, Gerald C. Hsu.

#healthtalk #eclairemd

Информация по комментариям в разработке