The dividend stock investing strategy may not work, if these critical mistakes are made. Learn about 5 mistakes to avoid as a dividend stock investor. (And, don't worry. All investors make mistakes and evolve.)

#dividend #stock #investing

Timestamps:

0:00 INTRODUCTION

0:23 MISTAKE 1: Taking a Setback and Letting It Derail The Investor's Journey

0:36 Check out my Patreon in the pinned comment below.

0:48 I faced a huge setback in 2023. I faced a huge value decline on Hawaiian Electric (HE) and, more importantly, a huge dividend income drop (with their dividend being suspended).

1:36 I took this setback to refocus on Realty Income (O), and I bought a ton of units below $50 and slightly above.

1:50 KEY: Take a bad situation and refocus on the positive.

3:01 KEY: It is inevitable that the investor will face setbacks on the journey.

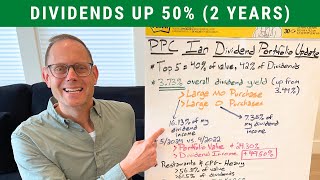

3:24 My portfolio is down -1.3%, but my dividend income is up 2.28%. And, that’s even with the HE dividend suspension. I went aggressively on Realty Income (O).

3:47 If HE did not have issues, my portfolio would have been up 0.5%, and my dividend income would have been up a staggering 5.71%.

4:12 LESSON: Smaller companies are not as exciting to me anymore in our "winner takes all" society.

4:47 MISTAKE 2: Getting Bored and Making Sub-Optimal Investments (or giving up altogether)

5:10 Selecting the right stocks is key, but it’s not that difficult.

5:33 There's so much more to dividend investing: persistence, determination, grit, not giving up, not getting bored.

6:26 In my early days, I had so much great stock picks: ABBV, GIS, SO, SBUX.

6:48 My portfolio got too big, but now I've trimmed it back down.

7:05 Some of the incremental companies I added (past position 37 were not as successful for me).

8:00 KEY: Don't focus so much time on stock picking. Focus on not getting bored.

8:30 KEY POINT: In the early days of my channel, the stock market was in a very favorable place. It was easier to pick great stocks. Stock picking has become more difficult.

9:11 Dividend investing works with individual stocks, it works with ETFs, it works with both.

10:09 MISTAKE 3: Being Fearful in Down Markets. (Buying High and Selling Low.)

10:30 The money is made in bear markets. I was buying Starbucks (SBUX) during the depths of the pandemic bear market.

12:09 BEAR MARKET RULES

12:54 Value stocks are lagging Growth stocks this year (since July).

14:15 MISTAKE 4: Thinking That It's All About Stock Picking

14:27 It's about time-in-market, capital deployed, being frugal.

15:27 MISTAKE 5: Listening To the Media

25:54 Often, I like to do the opposite of what mainstream media says.

16:17 Mainstream media would lead you to believe that big oil has no future.

17:01 Contrarian Investing

17:30 PPC Ian Is Here Because I Want You To Succeed

18:29 I'm still reinvesting a good 45%+ of my dividends, but over time I will use more dividends to fund my life.

18:59 SLIDE: DIVIDEND STOCK SELECTION

19:10 Dividend Aristocrats

19:42 SLIDE: MY DIVIDEND STOCK INVESTING PHILOSOPHY

20:38 KEY: Have excess cash on the sidelines to avoid tapping into the portfolio for large purchases.

21:02 DISCLOSURE AND DISCLAIMER

DISCLOSURE: I am long Johnson & Johnson (JNJ), PepsiCo (PEP), Procter & Gamble (PG), Realty Income (O), Hawaiian Electric (HE), Southern Company (SO), General Mills (GIS), AbbVie (ABBV), Starbucks (SBUX), Utz Brands Inc. (UTZ), The Home Depot (HD), and SCHD. I own these stocks in my personal dividend stock portfolio.

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.

Информация по комментариям в разработке