Join this channel to support me and get access to perks:

/ @investing_with_andrew

Starbucks Stock Analysis: Good Stock to Buy at 52-Week Lows? $SBUX Stock

With Starbucks (NASDAQ: SBUX) being down quite a bit from its peak and getting a lot of attention recently thanks to a very interesting plan, let’s see if there might be an opportunity here.

Starbucks has $6.5 billion in current assets, which isn’t enough to cover the current liabilities, and overall, the total assets don’t cover the total liabilities. So, they have quite a big issue.

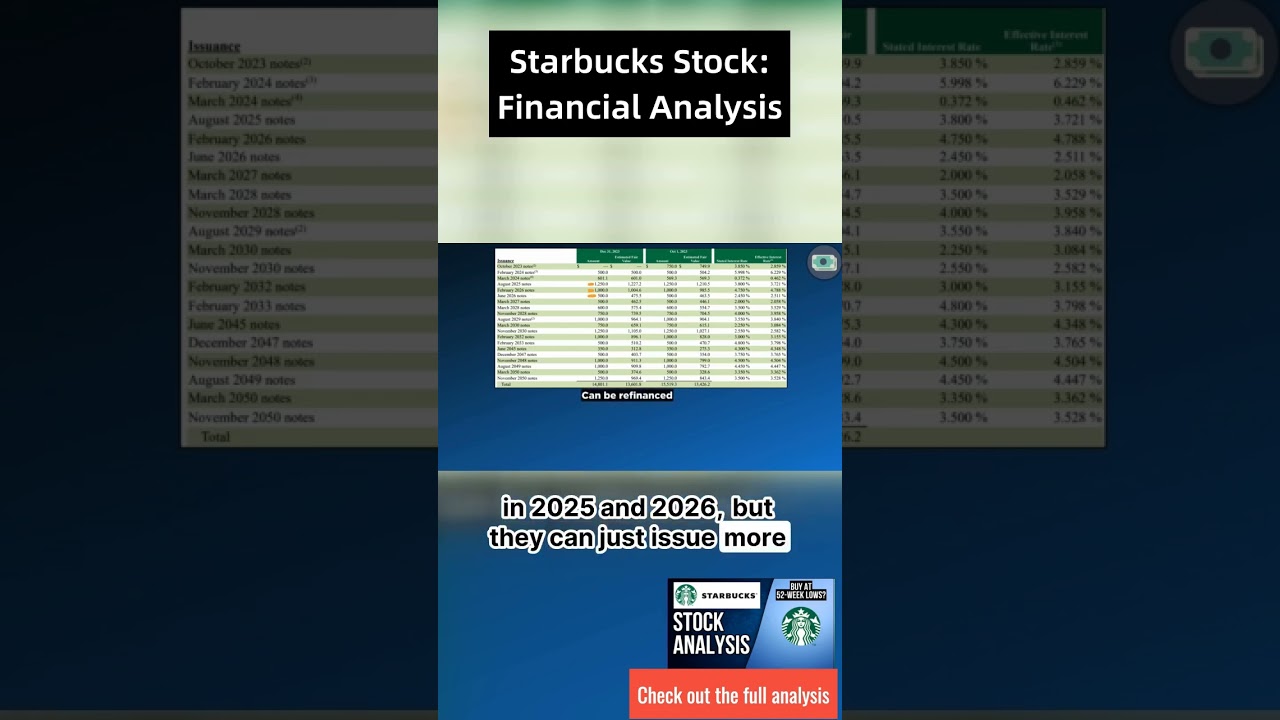

The debt is spread pretty well in the future, but the interest is $1.5 billion, and the dividend is another $2.6 billion, so there goes the cash flow. Not to mention the massive buybacks.

The debt repayments might be a bit of an issue in 2025 and 26, but they can just issue more and refinance. They even have some notes in the 2050s for a small interest rate, so the market has been pretty confident in them so far. Overall, the average interest rate is really not high at all but if the Fed doesn’t reduce the rates for 1 or 2 years, refinancing this can pile up the interest, and then the issues would begin.

But, if they focus on improving the balance sheet, based on the current cash flow, it can look much much better in 3-4 years. However, the dividend would have to be cut, but in just a couple of years, this can be a much better company.

This is ultimately a matter of management, and they seem to be focused on other things. Overall, this isn’t the most financially healthy company.

There is a reinvention plan that looks pretty promising as they focus on growing the number of stores, especially in China. There is still a lot of money that can be made internationally, so focusing on China, India, Europe and so on, can still unlock a lot of growth. And the good thing about opening a store is that they open it in a few months or even less and it produces money. It’s not a mine that you have to prepare and get all the approvals or a product that they have to create and market - it’s a Stabucks. So, they already have an impact on the earnings, as you are about to see in a bit.

As a result, the CAPEX would basically double from 2-3 years ago, so you can say that they are in an investment cycle. If they keep going, lower interest rates might also be pretty good to have.

We can see significant changes in Starbucks' management recently and this geographic focus can maybe help with the plan as each of the CEOs would have a clear focus on their markets.

Starbucks' EPS guidance is also very interesting. 15-20% growth for such a big company in the current environment is very attractive. This is related to the plan and if they manage to do it and keep doing it in the long-term, this can help improve the balance sheet without having to cut the dividend.

Now, can Starbucks reach this level of growth? Well, it’s not impossible at their size and for them it’s actually less than the average, and if they do it, the stock usually tends to follow.

Other videos:

Lithium Stocks (Arcadium Lithium/Allkem/Livent, Albemarle, SQM, Lithium Americas/Argentina) - • Lithium Stocks: Hidden 10-Bagger Gems? ALB...

Verizon (VZ) Stock Analysis - • Verizon Stock Analysis: A Stock to Buy in ...

Barrick Gold (GOLD) Stock Analysis - • Видео

Arcadium Lithium (ALTM) Stock Analysis - • Arcadium Lithium Stock Analysis: Arcadium ...

Medical Properties Trust (MPW) Stock Analysis - • MPW Stock Analysis: Why I'm BUYING Medical...

PayPal (PYPL) Stock Analysis - • PayPal Stock Analysis: Is PayPal TOO CHEAP...

Stellantis (STLA) Stock Analysis - • Stellantis Stock Analysis: The Best EV Sto...

Nokia (NOK) Stock Analysis - • Видео

Alibaba (BABA) Stock Analysis - • Alibaba Stock Analysis: Huge Growth Cataly...

Don't forget to like and subscribe if you appreciate what I do!

On my channel, you will find a wide variety of stock analyses - from gold miners such as Barrick Gold (NYSE: GOLD) and Newmont Mining (NYSE: NEM) to tech stocks like Nokia (NYSE: NOK), Alphabet (NYSE: GOOG/GOOGL), Intel (NYSE: INTC) and even healthcare REITs like Medical Properties Trust (NYSE: MPW) and Omega Healthcare Investors (NYSE: OHI).

Although I mostly focus on value investing, there will also be plenty of high-yield dividend stocks being analysed on the channel, especially if I believe that there is value in there.

Song: ♪ Marshmallow (Prod. by Lukrembo)

Link: • lukrembo - marshmallow (no copyright music)

DISCLAIMER: I am not a financial advisor and nothing on this channel should qualify as investing advice. All information is provided for your education or entertainment. It is not intended to be investment advice. This information is general in nature and has not taken into account your personal financial position or objectives. Seek a duly licensed professional for investment advice.

0:00 Starbucks Stock Review

0:10 Starbucks Financial Analysis, Dividend, Risk-Reward, Reinvention Plan

4:43 Starbucks Valuation, Price Target, Conclusions

#stocks #investing #personalfinance #valueinvesting

Информация по комментариям в разработке