📜 Viral Description

💥 GST on Other Income — क्या आपको पता है कि आपकी Side Income, Freelance Earnings या किसी Extra Source से कमाई पर भी GST लग सकता है? 🤯

इस वीडियो में हम आपको Latest GST Rules 2025 के साथ Other Income पर GST का पूरा गेम समझाएंगे — Examples, Threshold Limits, Legal Sections और Real-Life Cases के साथ 📊📚

✅ जानिए — कौन सी Other Income GST के दायरे में आती है

✅ किन लोगों को Registration लेना जरूरी है

✅ GST Return Filing में Other Income कैसे दिखाएं

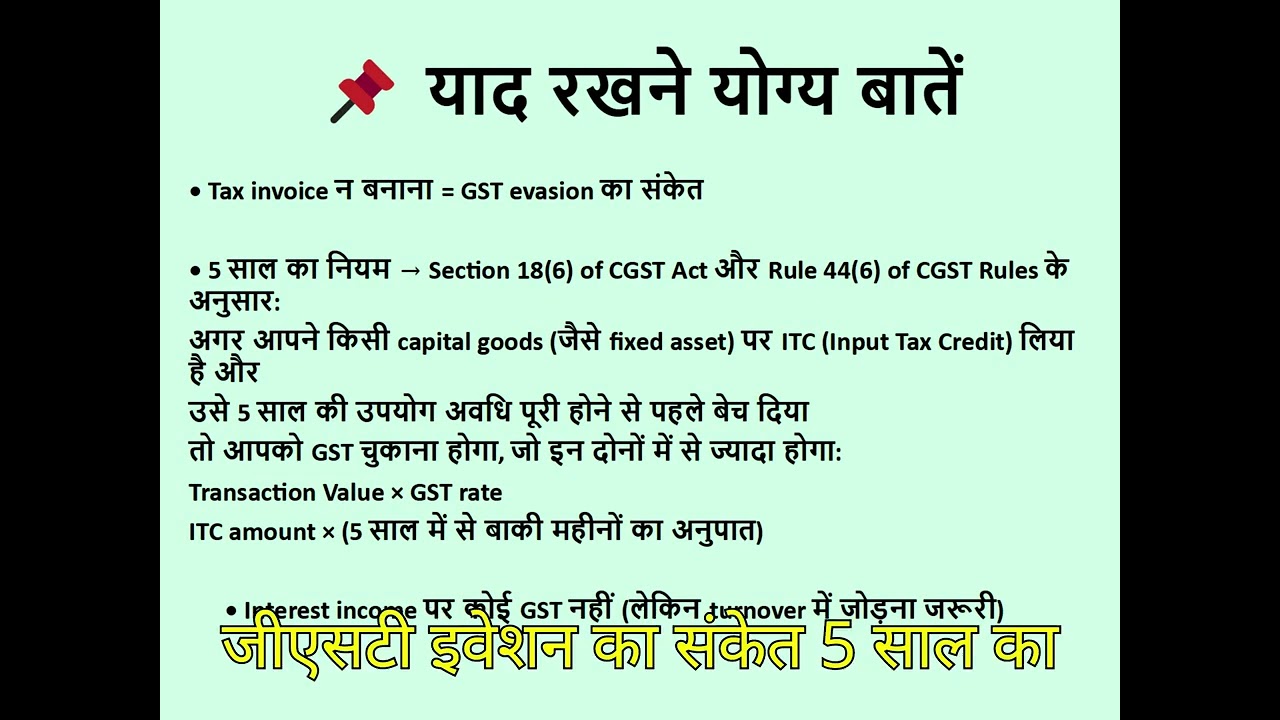

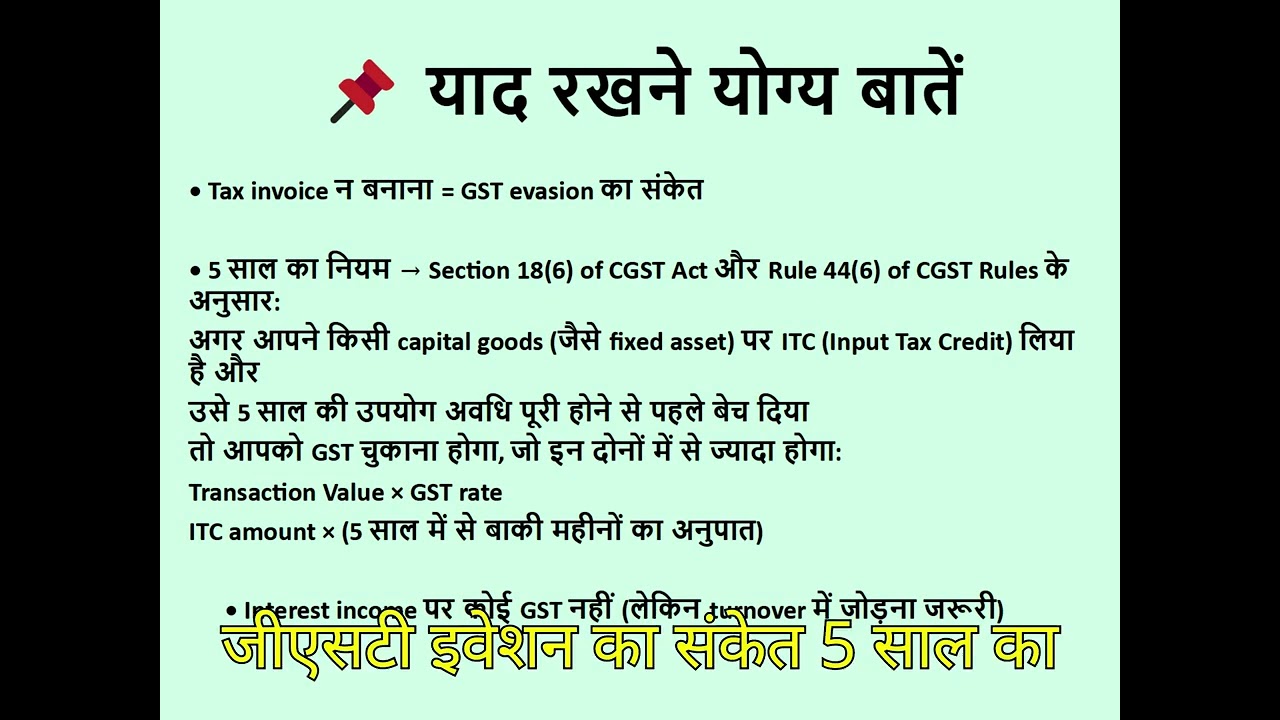

✅ Common Mistakes जो आपको Notice दिला सकती हैं 🚨

📌 Watch till the end to save yourself from heavy GST Penalties and make your compliance smooth!

📅 Updated as per Budget 2025 Changes

💡 For business owners, freelancers, consultants, and anyone earning extra income!

📚

"When Ramesh searched for GST on Other Income, he found that GST applicability on miscellaneous income also covered GST on freelance income and even GST on commission income. He read about GST registration threshold limit and how GST on rental income could be different from GST on interest income. He wanted to know about GST return filing and GST payment due date to avoid penalties. His friend told him about GST input tax credit rules and GST section 7 supply which clarified scope of supply. They also discussed GST RCM applicability and GST penalty for non-filing. Later, he explored GST exemption limit 2025, GST rate chart 2025, and GST advance ruling cases. He checked GST audit requirements, GST e-invoice rules, and GST annual return due date. To stay updated, he followed latest GST notifications 2025 and GST council meeting updates. Finally, he kept a list of common GST mistakes to avoid, GST late fee waiver news, and GST portal login issues to handle compliance smartly.

🔥

#GSTonOtherIncome #GST2025 #OtherIncomeTax #GSTRules #GSTUpdate #GSTReturnFiling #GSTRulesIndia #FreelanceGST #SideIncomeGST #BusinessGST #IncomeTaxVsGST #GSTRegistration #GSTExemption #GSTCompliance #GSTRCM #GSTPenalties #GSTForFreelancers #GSTCouncilUpdates #GSTRate2025 #GSTNotifications #GSTFilingTips #GSTNews #GSTLatestUpdate #GSTAudit #GSTRulesExplained

GST on Other Income, GST applicability on miscellaneous income, GST on freelance income, GST on commission income, GST registration threshold limit, GST on rental income, GST on interest income, GST return filing, GST payment due date, GST input tax credit rules, GST section 7 supply, GST RCM applicability, GST penalty for non-filing, GST exemption limit 2025, GST rate chart 2025, GST advance ruling cases, GST audit requirements, GST e-invoice rules, GST annual return due date, latest GST notifications 2025, GST council meeting updates, common GST mistakes to avoid, GST late fee waiver news, GST portal login issues, GST rules India

Disclaimer: In all the videos on this channel, some photos and videos used are shown only as examples and for educational purposes only,we will not be responsible in any circumstances for any decision which you have taken after watching the content and this is general guidance only. Consult a CA or Specilised personal for advice. Tax laws subject to change. Refer official portal for latest rules." Thank you

Информация по комментариям в разработке