CINCINNATI (WKRC) - Next week, thousands of dollars are expected to begin flowing directly to many of you, thanks to the $2 trillion coronavirus stimulus package that passed in Congress.

But confusion about how you’ll get that money has opened opportunity to scammers, ready to con you out of cash when you need it most.

SCAM WARNINGS

FBI, IRS and the Federal Trade Commission (FTC) are among many federal and state agencies warning about scams targeting economic impact payments that will soon start arriving from the federal government.

The FTC is warning scammers are using phishing emails, text messages and calls claiming to be agents of the government to lure you in to their scams where they try to trick you into giving personal information and bank accounts to steal your money on the premise that you need to do something to get your money from the stimulus package.

The opportunity is based on the huge amount of money that’s about to begin flowing and confusion about what you need to do to get your share.

WHO GETS HOW MUCH MONEY

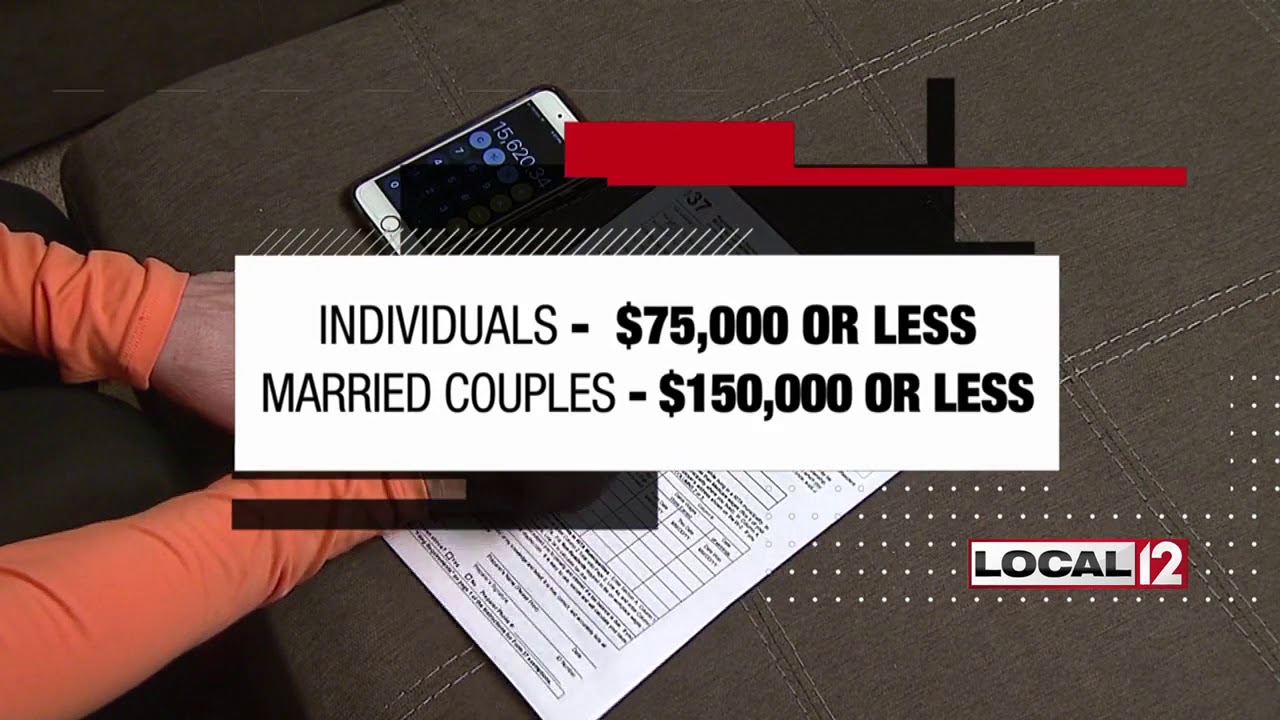

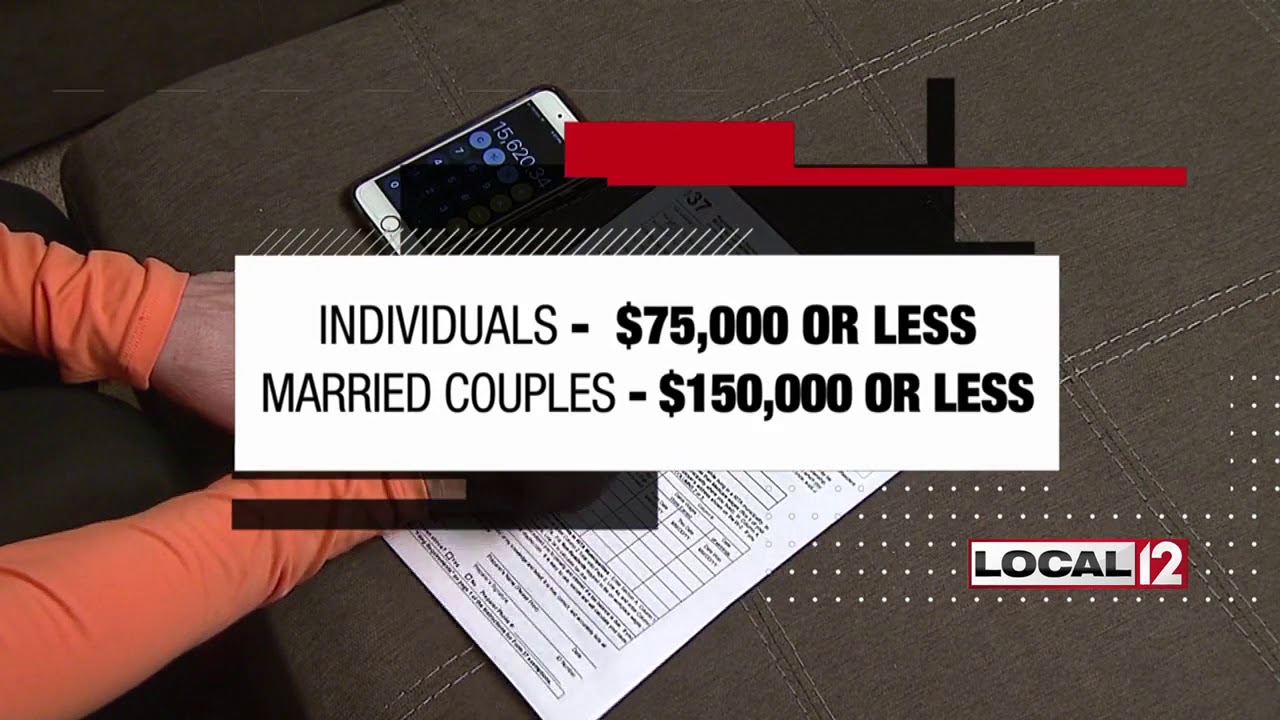

When Congress passed the $2 trillion coronavirus stimulus package, it approved sending a maximum of $1,200 to individuals, $2,400 to married couples and $500 for children under the age of 17.

To qualify for full payments, individual taxpayers must have an annual adjusted gross income of $75,000 or less and married couples who file joint returns must make $150,000 or less annually.

If you don’t qualify for the full relief, you will likely still receive money, but it will be reduced depending on how much you made.

Here is the full explanation from the IRS:

Who is eligible for the economic impact payment?

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Social Security recipients and railroad retirees who are otherwise not required to file a tax return are also eligible and will not be required to file a return.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

MOST OF US “DON’T NEED TO DO ANYTHING”

Now that you know what you can expect to receive, the question quickly turns to what do you need to do to get that money? The FTC has that simple answer: "You don’t need to do anything."

That’s right. For the overwhelming number of you, you don’t need to do a thing. The IRS, which is handling the payments, states on its website, “The vast majority of people do not need to take any action."

That’s because the IRS has all your income information already and is doing the calculations on how much money to send to you.

"Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment," the IRS states, adding that the payments, “will be deposited directly into the same banking account" as the one you listed for refunds.

If you didn’t sign up for direct deposit, the IRS says it will mail a check to you or you can give your bank account information on a page that the IRS will soon set up online. If you haven’t filed taxes in 2018 or 2019, the IRS says you can still do that and qualify for the payments.

ALL THE IRS ANSWERS ARE HERE

THE RIGHT AND WRONG

So, if you get an email, text or call telling you that you need to verify your information, pay a fee or do anything at all to get economic impact payments from the government, it’s definitely WRONG because it’s a scam!

The only thing most of us need to do is wait for the money to arrive and, in the midst of this seemingly-endless coronavirus crisis, that should feel RIGHT!

Информация по комментариям в разработке