This video goes over the basic concepts of calculating deadweight loss, and goes through a few examples. More information on this topic is available at http://www.freeeconhelp.com/2011/10/h...

Deadweight loss occurs when market equilibrium is not equal to efficient equilibrium. This means that the marginal benefit of society is not equal to the marginal cost of society so there is a disconnect between the true benefits and costs. In this case, total surplus is not as large as it could be which means that there is a loss to society. Since this isn't a necessary loss, economists call it a "deadweight" loss meaning that we could easily remove it but nudging markets toward the efficient outcomes.

Please comment below, I love when you find something helpful or if you have questions or criticism please feel free to share!

Also, if you found this helpful remember to like and subscribe to freeeconhelp's channel: https://www.youtube.com/freeeconhelp/...

Get Social:

***********************

Our website: https://www.freeeconhelp.com

Please like us on facebook at: / freeeconhelp

Follow us on twitter: / freeeconhelp

Below is a summary of the transcript for the video:

3.450,:10.519

This video is going to go over how to calculate deadweight loss and kind of describe. What Deadweight. Loss is so dead weight Loss

:11.099,:13.099

arises from an

:13.110,:15.110

economy not having the maximum

:15.540,:16.920

Surplus possible

:16.920,:21.860

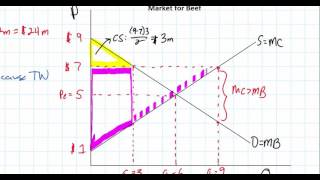

So if we look at a perfectly competitive model we have our supply and demand lines

:22.259,:26.238

The area above price and below demand is our consumer surplus

:26.759,:28.2

the area

:28.2,:31.189

below price and Above supply is our producer surplus

:32.070,:37.189

So there's no Deadweight loss in this economy because surplus is maximized

:38.670,:46.640

however if we were to institute a tax or there's an externality or something like that, then we would have a

:48.420,:52.070

shift in one of these curves

:53.399,:55.579

Where the Optimum should be?

:56.909,12.869

Here, but instead we're here and so that difference

15.070,18.930

Between where we should be and where we are?

1:10.950,1:16.250

Gives us a Deadweight loss that's occurred in the economy so first What is a deadweight loss?

1:17.1,1:18.960

What's causing it?

1:18.960,1:23.089

It's a difference between Marginal cost and marginal benefit

1:23.340,1:29.210

so you'll notice that at our optimum we have marginal cost equally marginal benefit and

1:29.909,1:31.530

We're good

1:31.530,1:36.559

However if MC prime is our true Marginal cost in the economy

1:37.079,1:44.989

Then we do not have marginal benefit equal to marginal cost because we want to be here instead of here

1:45.390,1:48.439

So everywhere between these two curves

1:49.950,1:56.990

We have a difference between marginal cost and marginal benefit and that creates the deadweight loss

1:58.049,2:.049

So let's go through an example

25.049,2:11.129

We're going to begin our economy in equilibrium

2:13.810,2:20.399

and just to make things easy let's say that the initial equilibrium is 5

2:21.850,2:29.789

5 so then the government decides it decides that they want to institute a tax and let's call it a supply-side, tax

2:34.060,2:41.399

So that's supply plus t our new equilibrium is going to be at this point and let's just say that

2:44.769,2:47.309

results in a price instead of 6 a

2:48.519,2:55.709

quantity of 4 and then here this price that the suppliers receive is 4

2:57.250,3:.389

so here the quantity of the tax is 2

31.269,34.829

The line shifted up by the amount of to the suppliers

35.799,39.479

Take half the tax and the consumers take half the tax

3:10.209,3:14.219

So again remember with Deadweight loss we want to be here

3:14.799,3:17.429

at a quantity of 5 and a price of 5

3:17.829,3:23.459

but we end up it here at a quantity of 4 price after tax of 6

3:23.769,3:28.048

our sorry price before tax of 6 and price after tax of 4

3:28.660,3:31.229

So remember this is our marginal benefit

3:31.810,3:36.6

This is our marginal cost and this is our marginal cost plus the tax

3:37.269,3:41.129

So what's going on in the economy is at this point right here?

3:41.380,3:44.130

We're losing out on Potential Surplus

3:44.350,3:50.850

Because the true marginal benefit of the economy is still greater than the true marginal cost of the economy

3:51.040,3:53.040

It's just that the tax

3:53.290,3:54.760

has

3:54.760,4:.660

Taken away that potential because now suppliers have to pay a tax instead of realizing their true gains

41.299,47.319

So everywhere between the marginal benefit and marginal cost from this new quantity

48.440,4:12.239

To the old quantity is going to be deadweight Loss

4:14.740,4:19.469

the neat thing about this is just the area of the triangle and if you remember

![Расчет эластичности спроса [С УЧЕТОМ ИЗМЕНЕНИЯ ЦЕНЫ] | Думай об экономике](https://i.ytimg.com/vi/5JzrJNYl8ng/mqdefault.jpg)

Информация по комментариям в разработке