This year, unexpected medical bills and healthcare expenses top the list of the average American’s financial worries. Three out of four adults say they are “very” or “somewhat worried” about unexpected medical bills and the cost of healthcare services. About 55% worry they cannot afford prescription medications. While 43% of Americans worry about paying their monthly health insurance premium.

Today, we're tackling a topic that can really impact your wallet if you’re not careful: out-of-network healthcare providers. With unexpected medical bills being a top financial concern for many Americans, understanding what 'out-of-network' means can save you a lot of money and stress. So, let’s dive right in!

When you’re looking for a healthcare provider, you’ve probably seen the terms in-network and out-of-network thrown around. But what do they actually mean? Well, it’s not about the quality of care or how good the provider is. It’s all about whether your healthcare provider has a contract with your health insurance company.

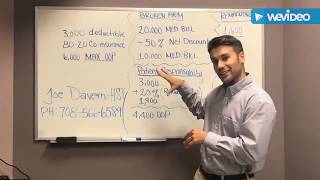

An in-network provider has an agreement with your insurance to offer services at a pre-negotiated rate. On the other hand, an out-of-network provider doesn’t have that agreement. This means if you see an out-of-network provider, you might be on the hook for the full cost of your care, or at least a bigger portion of it.

So, why does it matter if your provider is out-of-network? Like I mentioned, the main reason is the cost. Without a contract between your insurance and the provider, there’s no discounted rate. You’re paying what the provider charges, and that can be significantly more than the in-network rate.

Not only that, but your share of the cost is likely higher too. Think about your copays and coinsurance—those might not apply here, meaning you’ll have to cover a larger percentage of the bill yourself. And if your insurance does pay a portion, you could still be responsible for the difference if the provider charges more than what your insurance will cover. This is known as balance billing, and it can be a nasty surprise if you’re not prepared.

So now, let’s talk about how to avoid these extra costs. First off, always check if the provider you’re planning to visit is in-network. This information is usually easy to find on your insurance company’s website, or you can call the customer service number on the back of your insurance card.

Even if your primary provider is in-network, don’t assume that all services related to your care will be, too. Lab work, anesthesia, or radiology services could be handled by out-of-network providers, leading to unexpected charges. It’s important to ask questions and get all the details before your appointment.

Another thing to keep in mind is that insurance networks can change throughout the year. Providers can join or leave a network, so it’s a good idea to review your insurance company’s provider directory regularly. And if you do end up needing to see an out-of-network provider, don’t be afraid to discuss costs upfront. They might be willing to negotiate a discount or set up a payment plan.

Understanding the difference between in-network and out-of-network providers is crucial for managing your healthcare costs. By sticking to in-network providers, you can avoid surprise bills and keep your expenses in check. But if you do need to see an out-of-network provider, do your research and plan ahead to minimize the financial impact.

►Reach out to Etactics @ https://www.etactics.com

►Subscribe: https://rb.gy/pso1fq to learn more tips and tricks in healthcare, health IT, and cybersecurity.

►Find us on LinkedIn: / etactics-inc

►Find us on Facebook: /

#healthcare #healthinsurance

![[ANSWERED] What Causes Denial Code OA 23?](https://i.ytimg.com/vi/qBJxLVboFdQ/mqdefault.jpg)

![Visual Calculations in Power BI - DAX Made Easy! [Full Course]](https://i.ytimg.com/vi/JITM2iW2uLQ/mqdefault.jpg)

![[ANSWERED] What are NCCI Edits?](https://i.ytimg.com/vi/9rPET2_07n8/mqdefault.jpg)

Информация по комментариям в разработке