Hello guys welcome back on MAD TOP 10 Channel.

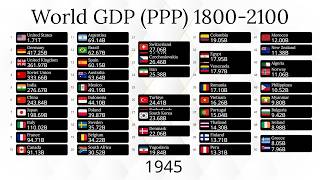

GDP PPP (purchasing power parity) is gross domestic product converted to international dollars using purchasing power parity rates. An international dollar has the same purchasing power over GDP as a U.S. dollar has in the United States. Purchasing power parities (PPPs) are the rates of currency conversion that eliminate the differences in price levels between countries.

GDP (PPP) per capita is GDP on a purchasing power parity basis divided by population. Please note: Whereas PPP estimates for OECD countries are quite reliable, PPP estimates for developing countries are often rough approximately.

PPP GNI is gross national income converted to international dollars using purchasing power parity rates. An international dollar has the same purchasing power over GNI as a U.S. dollar has in the United States.

Purchasing power parity is an economic term for measuring prices at different locations. It is based on the law of one price, which says that, if there are no transaction costs nor trade barriers for a particular good, then the price for that good should be the same at every location.[1] Ideally, a computer in New York and in Hong Kong should have the same price. If its price is 500 US dollars in New York and the same computer costs 2000 HK dollars in Hong Kong, PPP theory says the exchange rate should be 4 HK dollars for every 1 US dollar.

Poverty, tariffs, and other frictions prevent trading and purchasing of various goods, so measuring a single good can cause a large error. The PPP term accounts for this by using a basket of goods, that is, many goods with different quantities. PPP then computes an inflation and exchange rate as the ratio of the price of the basket in one location to the price of the basket in the other location. For example, if a basket consisting of 1 computer, 1 ton of rice, and 1 ton of steel was 1800 US dollars in New York and the same goods cost 10800 HK dollars in Hong Kong, the PPP exchange rate would be 6 HK dollars for every 1 US dollar.

The name purchasing power parity comes from the idea that, with the right exchange rate, consumers in every location will have the same purchasing power.

The value of the PPP exchange rate is very dependent on the basket of goods chosen. In general, goods are chosen that might closely obey the law of one price. So, ones traded easily and are commonly available in both locations. Organizations that compute PPP exchange rates use different baskets of goods and can come up with different values.

The PPP exchange rate may not match the market exchange rate. The market rate is more volatile because it reacts to changes in demand at each location. Also, tariffs and difference in the price of labor (see Balassa–Samuelson theorem) can contribute to longer term differences between the two rates. One use of PPP is to predict longer term exchange rates.

Because PPP exchange rates are more stable and are less affected by tariffs, they are used for many international comparisons, such as comparing countries' GDPs or other national income statistics. These numbers often come with the label PPP-adjusted.

There can be marked differences between purchasing power adjusted incomes and those converted via market exchange rates.[2] A well-known purchasing power adjustment is the Geary–Khamis dollar (the international dollar). The World Bank's World Development Indicators 2005 estimated that in 2003, one Geary–Khamis dollar was equivalent to about 1.8 Chinese yuan by purchasing power parity[3]—considerably different from the nominal exchange rate. This discrepancy has large implications; for instance, when converted via the nominal exchange rates GDP per capita in India is about US$1,965[4] while on a PPP basis it is about US$7,197.[5] At the other extreme, for instance Denmark's nominal GDP per capita is around US$53,242, but its PPP figure is US$46,602, in line with other developed nations.

Variations Edit

There are variations to calculating PPP. The EKS method (developed by Ö. Éltető, P. Köves and B. Szulc) uses the geometric mean of the exchange rates computed for individual goods.[6] The EKS-S method (by Éltető, Köves, Szulc, and Sergeev) uses two different baskets, one for each country, and then averages the result. While these methods work for 2 countries, the exchange rates may be inconsistent if applied to 3 countries, so further adjustment may be necessary so that the rate from currency A to B times the rate from B to C equals the rate from A to C.

#topgdp2050#indiagdpppp#pakistangdp

Facebook link -: https://www.facebook.com/profile.php?...

Hindi knowledge gallery -: / @hindiknowledgegallery6212

Amazon products (t shirts) -: https://amzn.to/3jreupZ

1).Amazon gadget-: https://amzn.to/2Eu3Uzk

2).Amazon gadget -:

https://amzn.to/3hxmpBl

Информация по комментариям в разработке