Subscribe to our YouTube channel: / @teachmepersonalfinance2169

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! https://www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

Below are links to articles and videos we've created on tax forms and schedules mentioned in this video or its accompanying article:

IRS Form 1116, Foreign Tax Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 1116 walkthrough (Foreign Ta...

IRS Form 1099-INT, Interest Income

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 1099-INT walkthrough (Intere...

IRS Form 1099-DIV, Dividends and Distributions

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 1099-DIV walkthrough (Divide...

IRS Form 4563, Income Exclusion For Residents of American Samoa

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 4563 Walkthrough (Exclusion ...

IRS Form 8978, Partner’s Additional Reporting Year Tax

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8978 walkthrough (Partner’s ...

IRS Form 2441, Child and Dependent Care Expenses

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 2441 walkthrough - ARCHIVED ...

IRS Form 8863, Education Credits

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8863 walkthrough (Education ...

IRS Form 8880, Credit for Qualified Retirement Savings Contributions

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8880 walkthrough (Credit for...

IRS Form 5695, Residential Energy Credits

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 5695 walkthrough (Residentia...

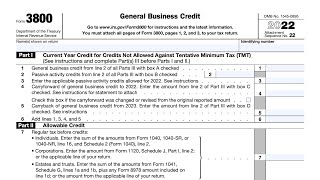

IRS Form 3800, General Business Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 3800 walkthrough (General Bu...

IRS Form 8801, Credit for Prior Year Minimum Tax

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8801 walkthrough (Credit for...

IRS Form 8839, Qualified Adoption Expenses

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8839 walkthrough (Qualified ...

IRS Schedule R, Tax Credit for the Elderly or Disabled

Article: https://www.teachmepersonalfinance.co...

Video: • Schedule R Walkthrough (Credit for th...

IRS Form 8910, Qualified Alternative Vehicle Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8910 walkthrough (Alternativ...

IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8936 walkthrough (Qualified ...

IRS Form 8396, Mortgage Interest Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8396 walkthrough (Mortgage I...

IRS Form 8859, Carryforward of the District of Columbia First-Time Homebuyer Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8859 walkthrough (Carryforwa...

IRS Form 8834, Qualified Electric Vehicle Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8834 walkthrough (Qualified ...

IRS Form 8911, Alternative Fuel Vehicle Recharging Property Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8911 walkthrough (Alternativ...

IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 4868 Walkthrough - ARCHIVED ...

IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 2350 Walkthrough (Extension ...

IRS Form 843, Claim for Refund and Request for Abatement

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 843 walkthrough (Claim for R...

IRS Schedule H, Household Employment Taxes

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule H walkthrough (Household...

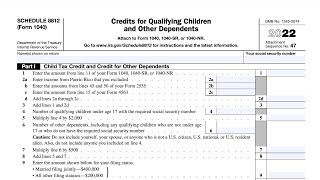

Use Schedule 3 if you have nonrefundable credits, other than the child tax credit

or the credit for other dependents, or

other payments and refundable credits.

Include the amount on Schedule 3,

line 8, in the amount entered on Form

1040, 1040-SR, or 1040-NR, line 20.

Enter the amount on Schedule 3,

line 15, on Form 1040, 1040-SR, or

1040-NR, line 31.

Информация по комментариям в разработке