The Nasdaq closed at a new high this week—but beneath the surface, not all indexes are showing strength. Is this a true breakout or just a temporary lift?

🔹 Monday: Markets bounced after weak jobs data hinted at a possible rate cut. The Dow surged 585 points, reclaiming key moving averages.

🔹 Wednesday: Nasdaq held above its 21-day line for three sessions, prompting IBD to raise exposure to 80–100%. But caution remains—another break could reverse that.

🔹 Thursday: Nasdaq volume rose, but stalling action signals potential weakness.

🔹 Friday: Nasdaq rallied 1%, hitting an all-time high.

🔮 Next Week Preview:

CPI (Tuesday), PPI (Thursday), and retail sales (Friday) will shape inflation outlook.

Earnings from Cisco (CSCO), Sea Ltd. (SE), Applied Materials (AMAT), plus hot IPOs CoreWeave (CRWV) and Circle Internet (CRCL).

📊 Covered: QQEW, RSP, 0TNX, UUP, USO, GLD, SLV, CPER, GBTC 📈 Sector Focus: SMH, IGV 💡 Key Stocks: NVDA, AVGO, TSM, AMD, MSFT, GOOGL, AMZN, META, AAPL, TSLA, NFLX

📌 Reference: Investors.com & MarketSurge

⚠️ Disclaimer: This is not investment advice. For informational purposes only.

#StockMarket #Nasdaq #SP500 #DowJones #MarketUpdate #TechnicalAnalysis #Investing #Trading #EconomicData #RateCut #Inflation #CPI #PPI #RetailSales #EarningsSeason #GrowthStocks #IPOWatch #TechStocks #FinancialNews #InvestorInsights #WeeklyRecap

Monday

-------

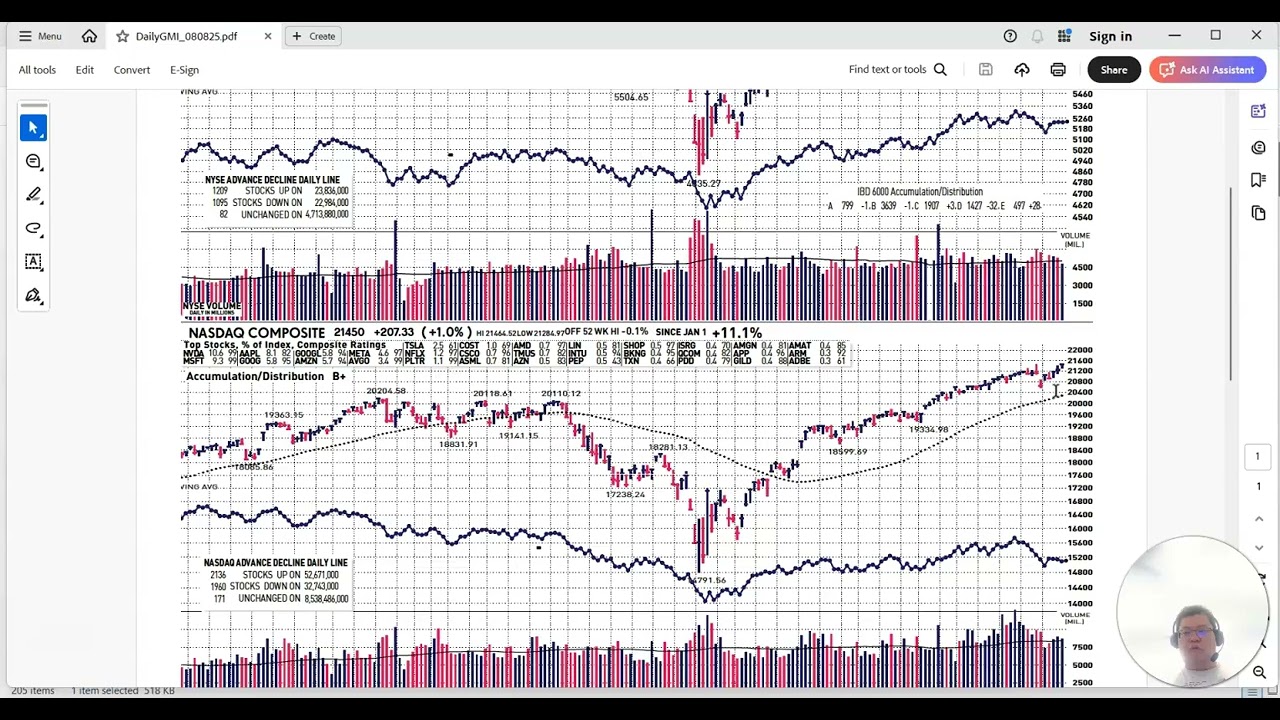

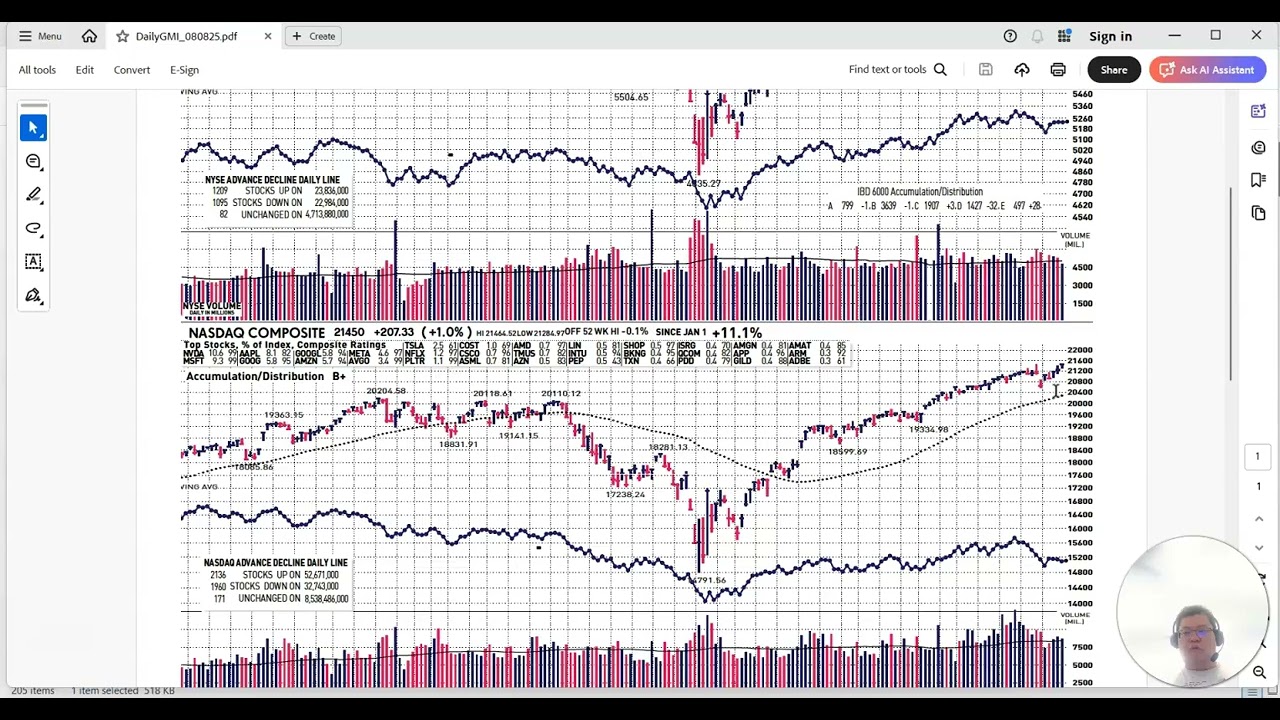

The Nasdaq and the S&P 500 were quick to retake their 21-day moving averages in Monday's stock market after Friday's weak jobs report raised the alarm on economic growth and strengthened the case for a September rate cut. The Dow Jones Industrial Average surged 585 points and rebounded from its 50-day moving average.

Wednesday

---------

After three straight closes for the Nasdaq above its 21-day line, and a series of higher lows over that time, IBD's invested percentage goes back up to 80%-100%. But another break of the 21-day line would result in lowered exposure again. For now, it doesn't make sense to argue with the uptrend in light of Wednesday's strength.

Thursday

--------

Volume rose on the Nasdaq, but fell on the New York Stock Exchange compared with Wednesday's trading session. Thursday's action on the Nasdaq qualified as a rare form of distribution, known as stalling. However, it is not added to the overall distribution day count since the July 15 stalling day is already in effect, combined with one regular distribution day on Aug. 5. One of the stalling day rules is that there can't be more stalling days than distribution days. So we'll put the July 15 stalling day on the shelf for now in case more distribution shows up.

In addition, investors considered initial unemployment claims. The Labor Department said that first-time claims climbed to 226,000, exceeding expectations. They were anticipated to rise to 220,000 vs. 218,000 in the previous week.

Friday

--------

The stock market rebounded from the prior week's sell-off to surge back near all-time highs.

The Nasdaq composite hit an all-time high as it rallied 1% Friday. It ended the week back above its major and short-term moving averages due to a lift of 3.9%, its third weekly gain out of the past four.

The S&P 500 turned in a more modest lift of 0.8%. The benchmark index turned in a weekly rise of 2.4%, and has risen in five out of the past seven weeks. It sits just off all-time high levels and holds a solid cushion on its 50-day moving average.

The Dow Jones Industrial Average lagged most out of the major indexes, but still rallied 207 points, or 0.5%.

Small caps also ended higher, with the Russell 2000 index squeezing out a measly 0.2% gain.

Growth stocks fared slightly better, with the Innovator IBD 50 (FFTY) exchange traded fund rising 0.4%.

Next week

--------

Inflation will be a key theme, with the consumer price index reading for July due Tuesday and producer price index data, which is more forward looking, coming Thursday.

U.S. retail sales data for July comes Friday. With consumer spending accounting for around two-thirds of GDP, this is an important gauge.

earnings:

Cisco Systems (CSCO), Sea Ltd. (SE) and Applied Materials (AMAT) have earnings due.

Hot IPO names CoreWeave (CRWV) and Circle Internet (CRCL)

QQEW, RSP,

0TNX, UUP, USO, GLD, SLV, CPER, GBTC

Advance/Decline

SMH

IGV

NVDA, AVGO, TSM, AMD

MSFT, GOOGL, AMZN, META

AAPL, TSLA, NFLX

Reference: Investors.com and Marketsurge

Disclaimer: This is not investment advice. It is for general information purpose only.

Информация по комментариям в разработке