Thirty questions in every Series 66 examination (30%) will test principles governing

investment recommendations and investment strategies. These thirty questions will cover the

following eleven components:

(1) Type of Client/Customer

o Individual, natural person, sole proprietorship

o Business entities (e.g., general partnership, limited partnership, limited

liability company, corporations (both C and S))

o Trusts and estates

o Foundations and charities

(2) Client/Customer Profile

o Financial goals and objectives

o Current and future financial situation (e.g., cash flow, balance sheet, existing

investments, tax situation, social security and pensions)

o Risk tolerance

o Nonfinancial investment considerations (e.g., values, attitudes, experience,

demographics, life events, behavioral finance)

o Client data gathering (e.g., client identification, questionnaires, interviews)

o Time horizon

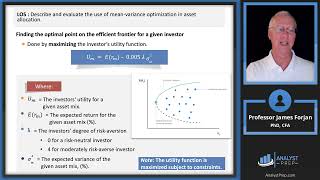

(3) Capital Market Theory

o Investment theories, models, and hypotheses (e.g., capital asset pricing model,

modern portfolio theory, efficient market hypothesis)

(4) Portfolio Management Strategies, Styles and Techniques

o Strategies (e.g., strategic asset allocation, tactical asset allocation)

o Styles (e.g., active, passive, growth, value, income, capital appreciation)

o Techniques (e.g., diversification, sector rotation, dollar-cost averaging, puts,

calls, leveraging, volatility management)

(5) Tax Considerations

o Income tax fundamentals, individual (e.g., capital gains, qualified dividends,

tax basis, marginal tax bracket, alternative minimum tax, pension and

retirement plan distributions, government benefit implications)

o Income tax fundamentals, corporations, trusts, and passthrough entities

o Wealth transfer, Estate tax and gift tax fundamentals

(6) Retirement Plans

o Individual retirement accounts (e.g., traditional, Roth)

o Solo 401(k) (e.g., traditional, Roth)

o Qualified retirement plans (e.g., 401(k) plans, 403(b) plans)

Page 11

o Nonqualified retirement plans (e.g., deferred-compensation plans, 457 plans,

executive bonus plans)

(7) Employee Retirement Income Security Act (“ERISA”) Issues

o Fiduciary issues (e.g., investment choices, ERISA § 404(c))

o Investment policy statement

o Prohibited transactions

(8) Special Types of Accounts

o Education related (e.g., 529 plans, Coverdell accounts)

o Uniform Transfers to Minors Act (“UTMA”) and Uniform Gifts to Minors

Act (“UGMA”)

o Health savings accounts, flexible spending accounts

(9) Ownership and Estate Planning Techniques

o Methods of ownership transfer (e.g., joint tenants with rights of survivorship,

tenants in common, tenancy by the entirety)

o Pay on death and transfer on death

o Beneficiary designation

o Trusts and wills

o Qualified domestic relations order

o Donor advised funds

(10) Trading Securities

o Terminology (e.g., bids, offers, quotes, market orders, limit or stop orders,

short sales, cash accounts, margin accounts, principal or agency trades,

payment for order flow)

o Roles of broker-dealers, custodians, market makers, and exchanges

o Costs of trading securities (e.g., commissions, markups, bid/ask spread, best

execution)

(11) Portfolio Performance Measures

o Returns (e.g., risk-adjusted, time-weighted, dollar-weighted, annualized, total,

holding period, internal rate of return, expected, inflation-adjusted, after tax)

o Current yield

o Relevant benchmarks

Информация по комментариям в разработке