#IndigoLearn #CA #Law #Revision#Share Capital

Download our app for Free MCQs, Free Notes, Free videos and amazing online classes for CA Foundation, CA Inter & CA Final

http://bit.ly/IL1FIN

For courses / modules for CA Foundation, CA Inter, CA IPCC, CA Final, CMA, CPA, CS please visit https://www.indigolearn.com or reach out to us at + 91 9640 11111 0

Share capital and debentures are crucial components of a company's capital structure, representing different forms of financing and ownership. Understanding their characteristics, issuance, and management is essential for financial management and compliance with regulatory requirements.

Share Capital:

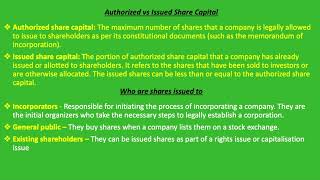

Share capital refers to the funds raised by a company through the issuance of shares to shareholders. It constitutes the permanent capital of the company and represents ownership interests. Share capital can be of various types, including equity shares, preference shares, and sweat equity shares.

Equity shares represent ownership in the company and entitle shareholders to voting rights and residual income (dividends). Preference shares, on the other hand, offer priority in dividend payments and capital repayment but generally do not carry voting rights.

The issuance of shares involves several steps, including obtaining necessary approvals, drafting prospectuses or offer documents, and complying with regulatory requirements such as SEBI guidelines and Companies Act provisions. Companies may issue shares through public offerings, rights issues, private placements, or preferential allotments.

Proper management of share capital requires compliance with legal requirements, maintenance of share registers, and timely reporting to regulatory authorities. Companies must also consider shareholder interests and market conditions when making decisions related to share issuances and capital restructuring.

Debentures:

Debentures are debt instruments issued by companies to raise funds from the public or institutional investors. They represent a loan agreement between the company and the debenture holders, who are entitled to receive fixed interest payments and repayment of principal amount at maturity.

Debentures can be classified based on various factors such as tenure, security, convertibility, and redemption terms. Common types include secured debentures, unsecured debentures, convertible debentures, and non-convertible debentures.

The issuance of debentures involves similar procedures as equity shares, including obtaining approvals, drafting offer documents, and complying with regulatory requirements. Companies must also adhere to disclosure norms and provide accurate information to investors regarding the terms and risks associated with debenture investments.

Proper management of debentures requires efficient debt servicing, which includes timely payment of interest and redemption of principal amount at maturity. Companies must maintain adequate liquidity and financial stability to meet their debt obligations and avoid default.

In conclusion, share capital and debentures are essential sources of financing for companies, each with its unique characteristics and implications. Effective management of share capital and debentures involves compliance with regulatory requirements, transparency in disclosures, and prudent financial planning to support sustainable growth and shareholder value.

Информация по комментариям в разработке