The stablecoin market is on the verge of a seismic shift as Ripple prepares to launch its own stablecoin, RLUSD, while stablecoin liquidity hits all-time highs.

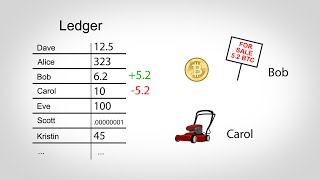

As Ripple gears up to officially introduce its Ripple USD (RLUSD) stablecoin, liquidity in the stablecoin market has reached unprecedented levels. This significant growth in market liquidity comes as Ripple aims to disrupt the $150 billion stablecoin market, leveraging its technological infrastructure, including the XRP Ledger (XRPL) and Ethereum network.

Ripple’s stablecoin project, though still in its beta phase, has drawn considerable attention. According to a recent report by CryptoQuant, Ripple could utilize RLUSD to target the remittance and money transfer sectors. By using the established systems of the XRPL and Ethereum, Ripple aims to streamline cross-border payments with its stablecoin offering.

The company initially announced its intention to enter the stablecoin market in April 2024, at a time when the market was valued at $150 billion. Projections indicate that the stablecoin market could grow to over $2.8 trillion within the next four years, presenting Ripple with a massive opportunity.

Since the beta testing of RLUSD began in August on the Ethereum network and XRPL, millions of tokens have been minted and burned, signaling strong activity. Ripple's CEO recently confirmed that the official launch of RLUSD is just weeks away, as the project approaches its final stages of development.

While Ripple prepares to launch RLUSD, the broader stablecoin market has been experiencing record-breaking liquidity. As of late September 2024, the total market capitalization of major stablecoins surged to $169 billion, marking a $40 billion increase year-to-date (YTD). This 31% rise in stablecoin market cap demonstrates the growing demand for these digital assets as a reliable medium for holding and transferring value in the volatile cryptocurrency space.

Tether’s (USDT) dominance continues to play a major role in driving liquidity. USDT balances on centralized exchanges have soared, with holdings on the Ethereum network (ERC20) reaching $22.7 billion in October—a staggering 54% increase since the beginning of the year. Similarly, USDT balances on the TRON network have risen to $8.5 billion, all held on centralized platforms.

USDT now accounts for 71% of the stablecoin market, with a market cap nearing $120 billion. Meanwhile, Circle’s USDC holds a 21% share, with its market capitalization rising to $36 billion, marking a 44% YTD growth. Together, USDT and USDC are responsible for the majority of liquidity in the stablecoin market, fueling more capital for traders to execute efficient trades.

As liquidity swells, Ripple’s RLUSD stablecoin could become a key player in this fast-evolving market. The RLUSD stablecoin, which operates on both the XRPL and Ethereum networks, may appeal to traders and institutions looking for stable, secure, and efficient transaction mechanisms in an increasingly volatile digital asset environment.

CryptoQuant has highlighted that a rise in stablecoin market capitalization is often linked to rising cryptocurrency prices, including Bitcoin. The continued growth of RLUSD and other stablecoins could bolster liquidity across the market, providing the necessary fuel for further price increases in the broader crypto ecosystem.

#xrpnewstoday #xrppriceanalysis #xrpripplenews #xrpnews #RLUSD #ripplenews

Информация по комментариям в разработке