🎥 Term Insurance Simplified — Complete Must-Know Series (Episodes 151–160)

Welcome to Insurance Simplified with Harish Singla — India’s most practical, unbiased and non-promotional learning platform for Life, Health, General, Motor, Home & Credit Life Insurance.

This video is part of our TERM INSURANCE MUST-HAVE SERIES (Episodes 151–160), created to help Indian families clearly understand what term insurance is, why it is needed, how much cover is enough, which plan to choose, and how claims actually work — all explained in simple language with real-life context.

📌 What You’ll Learn in This Term Insurance Series

Across Episodes 151 to 160, this series covers:

✔ Why Term Insurance is essential for every earning individual

✔ How Term Insurance protects your family’s income

✔ Different types of term plans & who they suit

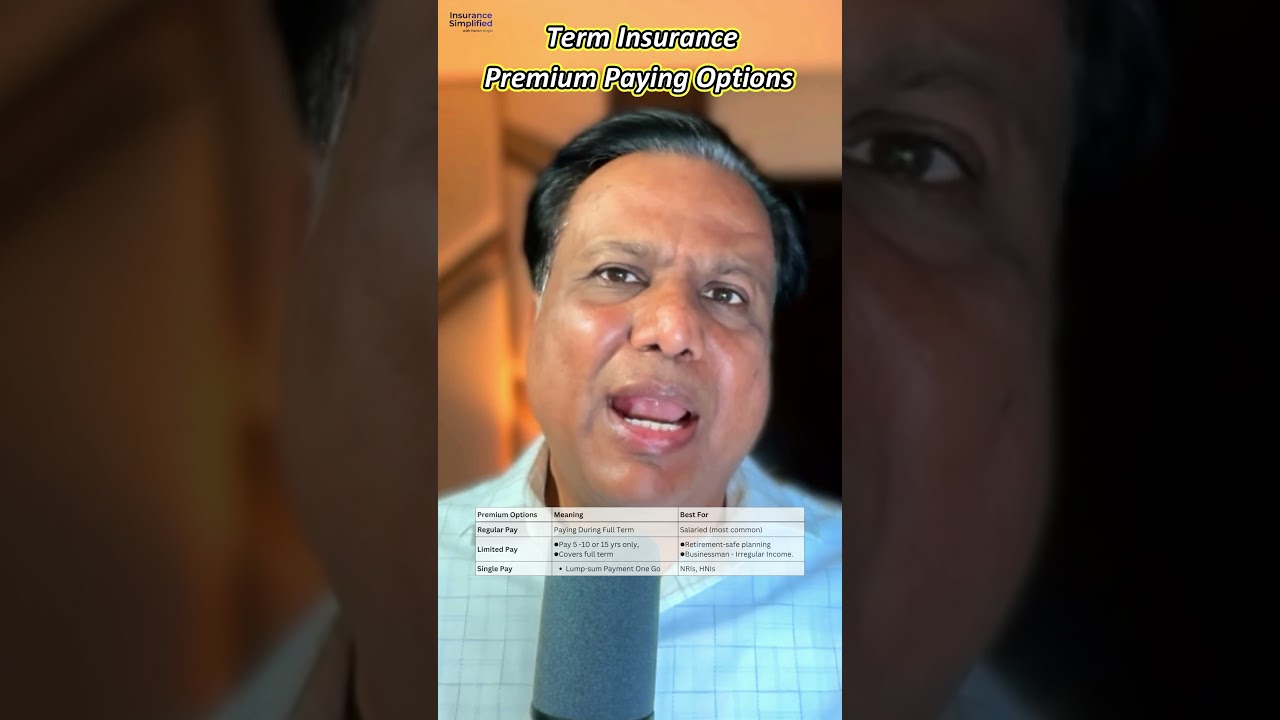

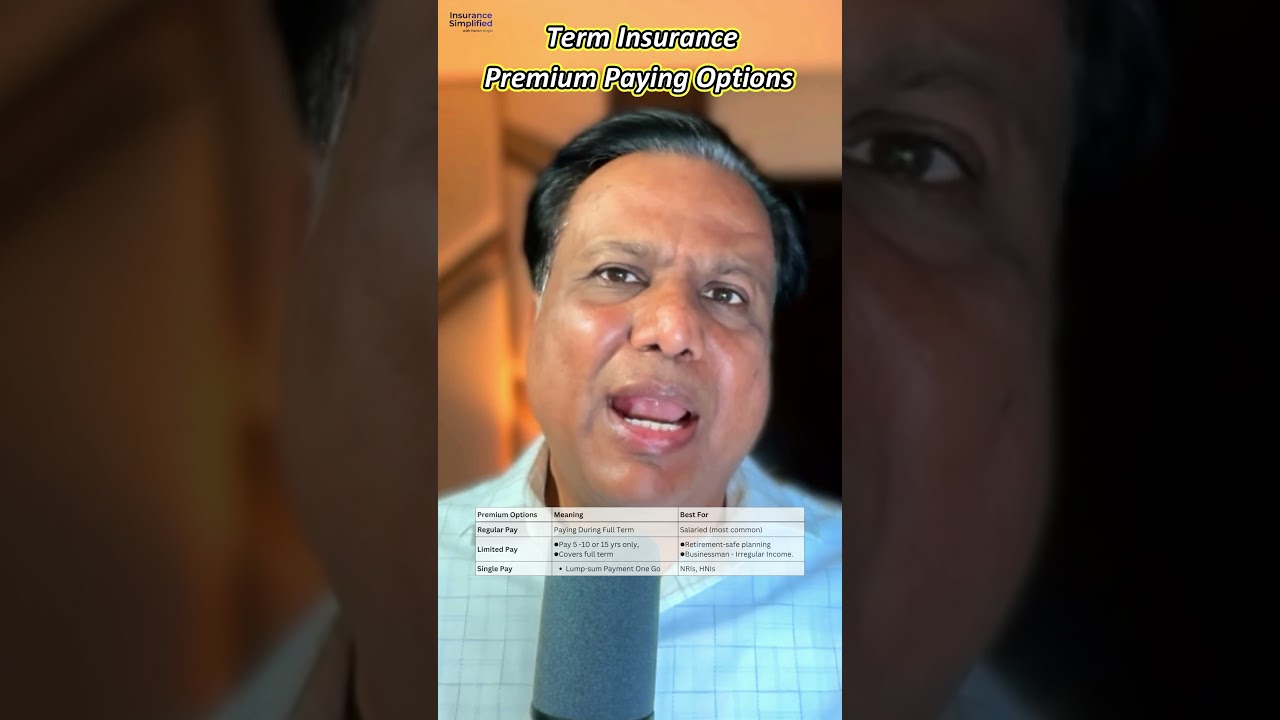

✔ Premium paying options & coverage duration explained

✔ How much term cover is enough (income, expense, DIME & HLV methods)

✔ Term insurance riders — critical illness, accidental & waiver of premium

✔ How term insurance fits into financial planning

✔ Pure Term vs Hybrid vs Savings plans — role clarity

✔ How to choose the right insurance company

✔ Term insurance claim process — step-by-step, for families

Each episode is designed as a short, focused, 3–5 minute explainer so that every topic is easy to understand and easy to apply.

🌟 About This Channel — Insurance Simplified with Harish Singla

Insurance Simplified is a non-monetized, non-promotional and unbiased educational initiative focused on increasing insurance awareness and preventing costly customer mistakes.

This channel exists for one simple purpose:

👉 Help every Indian family make insurance decisions with clarity, confidence and zero confusion.

Every video on this channel helps you:

✔ Understand policy wording and coverage

✔ Avoid hidden clauses, exclusions and restrictions

✔ Decode claims, cashless, reimbursements & deductions

✔ Compare insurance products intelligently

✔ Choose the right riders, add-ons & top-ups

✔ Avoid common customer mistakes that lead to financial losses

✔ Save money by selecting the right features

✔ Understand how insurance works behind the scenes

🔹 Topics Covered on This Channel

🔹 Life Insurance

Term insurance explained

Benefits, riders & income protection

Policy structure, underwriting & claims

🔹 Health Insurance

Room rent, co-pay, deductibles & sub-limits

Cashless & reimbursement claims

Top-up & super top-up plans

Corporate vs individual health insurance

🔹 General Insurance

Motor insurance (car & bike)

Zero depreciation, RTI, engine protect, RSA

Home, fire, burglary & property insurance

Travel, cyber & liability insurance

Extended warranty & service protection

🔹 Credit Life Insurance

Loan-linked life cover

Home loan protection

Risk pricing & mortality logic

🔹 Insurance Distribution & Industry

Bancassurance

Agency & broking

Digital & embedded insurance models

🔹 Claims, Servicing & Fine Print

Claim assessment logic

Common deduction reasons

Required documents

Exclusions, waiting periods & sub-limits

Escalation & grievance processes

🌐 Recommended Playlists

(Coming Soon)

Term Insurance & Life Insurance Essentials

Health Insurance Simplified

Motor & Vehicle Insurance Guides

Home, Travel & General Insurance

Claims, Cashless & Fine Print Explained

Bancassurance & Insurance Distribution Channels

🔔 Stay Connected

Subscribe for unbiased, zero-promotion insurance education

Hit the bell icon 🔔 so you never miss an important update

🔍 SEO Keywords (Embedded Naturally)

Insurance Simplified with Harish Singla

Term Insurance India

Term Plan Explained

Life Insurance Education India

Best Term Insurance Guide

How Much Term Insurance is Enough

Term Insurance Riders Explained

Insurance Claim Process India

Financial Protection for Family

Insurance Awareness India

Bancassurance India

📌 Important Disclaimer

This channel is strictly educational.

All information shared is general in nature.

This channel does not promote, endorse or represent any insurance company, brand or product.

All content is non-monetized and non-promotional.

Views expressed are personal and not of any present or past employer.

For personalised advice, please consult a certified insurance advisor.

🔖 Hashtags (Use for All Term Insurance Videos)

#InsuranceSimplified

#TermInsurance

#LifeInsurance

#FinancialProtection

#InsuranceEducation

#InsuranceAwareness

#FamilySecurity

#InsuranceIndia

#Bancassurance

#InsuranceTips

Информация по комментариям в разработке