http://sensibleinvesting.tv -- the independent voice of passive investing

A remarkable 54-minute film featuring some of the world's top economists and academics and demonstrating:

how the claims of active fund managers to be able to beat the market are largely a myth

how costs are the biggest drag on performance - and why active costs more

how passive investing offers the best experience for the vast majority of investors

the benefits of a diversified portfolio in guaranteeing consistent returns

why passive investing is better for your health

why active investing has held sway for so many years....

... but why things may be changing

and why passive is the rational, mathematically proven route to investing success.

Investing for the future... It's an issue none of can afford to ignore.

No one's job is safe these days... How would you cope if you lost yours?

We're all living longer too... So are you saving enough to fund 25 years or more of retirement?

Can you really afford to pay for your children or grandchildren to go to university - or help them onto the property ladder?

And what about all those holidays you promised yourself?

We entrust the vast bulk of our investments to fund managers.

Here in the UK, according to Her Majesty's Treasury, the industry has more than four TRILLION pounds of investors' money under management.

Fund managers invest people's savings wherever they see fit - mainly in equities, or shares in listed companies.

They claim to be experts at making our making grow, using their expert knowledge to pick the shares that will outperform the market.

But all too often the returns they produce are considerably lower than the average return of a benchmark index like the FTSE 100 - or the S&P 500 in the States.

For veteran investment guru John Bogle, the problem is simple. Fund managers just aren't as smart as they like to think they are.

As it means trading against the view of numerous market participants with superior information, buying or selling a security is effectively just a bet. So, whilst your fund manager might lead you to believe it's his knowledge or intelligence that enables you to beat the market, he's really no better than a gambler.

So, you might be lucky enough to choose the right fund manager. But you could just as easily pick the wrong one.

According to the financial services company Bestinvest, there are currently nearly £10 billion of UK investors' money languishing in what it calls dog funds - in other words, funds which have underperperformed their benchmark index for at least three consecutive years.

Ultimately, of course, fund managers are businesses. They exist to make money for themselves. They want our business - even if it means persuading us to invest in a fund which they themselves wouldn't want to put their own money in.

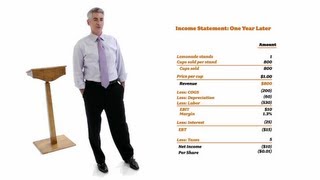

It's now time to look at what it actually costs us to invest.

Fund managers are, of course, businesses. And, like all business, they have overheads.

Running a big fund management company doesn't come cheap - esepcially when top managers earn around £2 million a year, including bonuses.

And remember, it's you, the customer, who picks up the tab.

Ultimately, though, fund managers need to make a profit.

In fact they'e making around £10 billion from us every year - and that's regardless of whether or not they manage to produce a profit for us.

Part of the challenge is working out exactly what we are being charged. Investors typically use something called the annual Total Expense Ratio, or TER, to compare the cost of investing in different funds. But, the TER excludes dealing commission, stamp duty and other turnover costs that can add considerably to the expense of investing over time.

So, apart from those hidden charges, what else are we having to pay? More importantly, what sort of impact do charges have on the value of our investments?

And the bad news doesn't stop there. Despite a marked increase in competition, management charges in the UK have been steadily rising over the last ten years.

There are some encouraging signs for consumers. The FSA's Retail Distribution Review will require fund managers to be fairer and more transparent when it comes to charges. In the meantime, investors should be on their guard.

For more videos like this one, visit http://sensibleinvesting.tv

Информация по комментариям в разработке