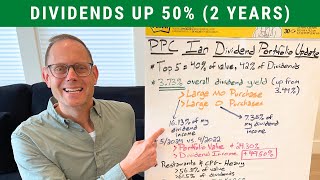

This dividend stock that yields almost 10% is going to change my life, accelerating my FIRE journey to a new level of velocity. Learn about the flow of money and dividends in my portfolio, and how I approach the dividend game. I'm excited to review my strategy and also take a look at British American (BTI) stock.

#dividend #stock #investing

0:00 I just bought British American (BTI), a dividend stock yielding almost 10%.

0:15 Putting money in a stock that yields 10% is really exciting. The cash flow is massive.

0:22 I bought a lot of Altria (MO) in late 2023, and that stock has worked really well for me.

1:02 THE FLOW OF DIVIDENDS

1:20 In my OG days, I started mostly with sin stocks.

1:39 Check out the pinned comment for a link to my Patreon.

2:08 There are many different ways to play the dividend stock investing game.

2:29 Right now, I need more cash flow NOW.

2:42 Three-Tier Flow of Money

3:15 9.5% dividend yield and a PE ratio in the 6s.

3:20 STEP 1: Capital To Deploy

3:23 STEP 2: Put the capital in a higher-yielding, annuity-like stock.

4:22 STEP 3: Use the dividends from Step 2 to fund "forever" ("Core") investments like SCHD, JNJ, and SBUX.

5:05 I have a tranche of Treasury Notes maturing. It was earmarked for SCHD, but I think I'll just put it in BTI.

5:30 KEY: Don't worry about what people think, nor how they perceive you as a dividend investor.

6:46 KEY: Step 2 investments are also "forever" companies. I don't sell them. They are just a different type of investment. They have higher risk.

7:38 Pros and Cons - Option 1 is "sleep-well-at-night", but Option 2 carries more risk (with FIRE coming quicker).

8:00 MY BTI DIVIDEND STOCK PURCHASE LAST WEEK

8:44 The forward PE is in the 6s.

9:13 Starting yield is 9.86%.

9:34 SLIDES FROM BTI INVESTOR WEBSITE

10:05 NOTE: I take out dividends from sin stocks. I generally don't reinvest them back into the company that paid the dividend.

10:28 SLIDE 1: US Combustible Brand Write-Off

11:11 Non-cash impairment charge.

12:14 SLIDE 2: Balance Sheet

12:31 You can see intangible assets tank, due to the write-off of the US brands (combustible market).

13:01 SLIDE 3: Income Statement

13:19 Depreciation, Amortization, and Impairment Costs

14:10 SLIDE 4: Free Cash Flow (It's Growing Really Well!)

14:55 The business is growing from a financial standpoint.

15:27 Adjusted results are growing (adjusted for the impairment charge). Adjusted diluted EPS is up 4% year-over-year.

16:08 Is this really a step 2 stock, or is it a step 3 stock on deep discount?

16:20 Broader society may hate this stock (and want it to go out of business), but the fundamentals show it's doing just fine.

16:56 SLIDE 5: New categories are growing FAST (28% CAGR)

17:40 SLIDE 7: 16% of revenue comes from smokeless!

18:22 The sin stocks trade at low values because people hate them and avoid investing in them.

18:39 A lot of mutual funds cannot even buy these stocks.

19:52 DISCLAIMER AND DISCLOSURE

DISCLOSURE: I am long British American (BTI), Altria (MO), Johnson & Johnson (JNJ), Starbucks (SBUX), and SCHD. I own these stocks (and ETF) in my personal dividend stock portfolio. I'm also long Treasuries.

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.

Информация по комментариям в разработке